How to Build Credit from Scratch ? Beginner’s Guide

Trying to build credit for the first time feels like a catch-22: You need credit to get a credit card, but you need a credit card to build credit.

If you have never borrowed money, you are what the industry calls “Credit Invisible.” This does not mean you have a bad score (like 300); it means you have no score at all. You are a ghost to the financial system.

Fortunately, building credit from scratch is actually easier than fixing bad credit. You have a clean slate. By following three specific steps, you can generate a FICO score in as little as six months.

The 6-Month Rule

Before you start, you need to know the timeline. You will not have a credit score on Day 1. FICO requires a credit account to be open for at least six months before it generates your first score. Patience is required.

Step 1: The Secured Credit Card (Your Best Option)

If no bank will approve you for a regular credit card, you get a Secured Credit Card. This is the gold standard for building credit from zero.

How It Works:

- You pay a deposit: You give the bank $200 (or more).

- That deposit becomes your limit: Your credit limit is exactly $200.

- Zero Risk for the Bank: If you don’t pay your bill, the bank keeps your $200 deposit. Because there is no risk for them, approval is nearly guaranteed.

The Strategy: Use this card to buy one small item a month (like a tank of gas or a Netflix subscription) and pay it off in full. After 6–12 months of on-time payments, most banks will “graduate” you to a regular card and refund your deposit.

Step 2: The “Authorized User” Method (The Shortcut)

If you have a parent, spouse, or close relative with excellent credit, this is the fastest way to get a score.

- Action: Ask them to add you as an Authorized User on one of their old credit cards.

- The Result: The credit bureaus “copy and paste” the entire history of that card onto your credit report. If that card has a 10-year history of perfect payments, you suddenly look like you have a 10-year history of perfect payments.

Warning: Only do this with someone you trust. If they miss a payment or max out the card, their bad habits will hurt your new score.

Step 3: Credit Builder Loans (For Non-Spenders)

If you don’t trust yourself with a credit card yet, a Credit Builder Loan is a safe alternative. It works backward compared to a regular loan.

- You apply for the loan: The bank puts the money (e.g., $1,000) into a locked savings account. You cannot touch it yet.

- You make payments: You pay the bank $85/month for a year.

- You get the money: Once you have paid the full $1,000, the bank unlocks the savings account and gives you the cash (minus a small interest fee).

Every monthly payment you make is reported to the credit bureaus, building a solid payment history without the temptation to overspend.

What NOT To Do (Common Traps)

When you have no credit, you are a target for predatory lenders. Avoid these mistakes:

- Avoid “Fee-Harvesting” Cards: Some subprime credit cards charge $99 application fees, $75 annual fees, and monthly maintenance fees. You should never pay hundreds of dollars just to have a card. Stick to reputable secured cards from major banks.

- Don’t Carry a Balance: There is a persistent myth that you need to carry a small debt to build credit. This is false. Paying your bill in full every month builds the exact same score as carrying a balance, but without the expensive interest charges.

- Don’t Apply for Everything: Every time you apply for a card, it causes a “Hard Inquiry,” which dings your invisible score. Pick one strategy (Secured Card) and stick to it for 6 months.

Frequently Asked Questions (FAQ)

Can I build credit with a debit card?

Generally, no. Standard debit card usage is not reported to Equifax, Experian, or TransUnion. However, newer services like Experian Boost™ can scan your bank account for utility and rent payments to give you a small credit lift, but this is less powerful than a credit card.

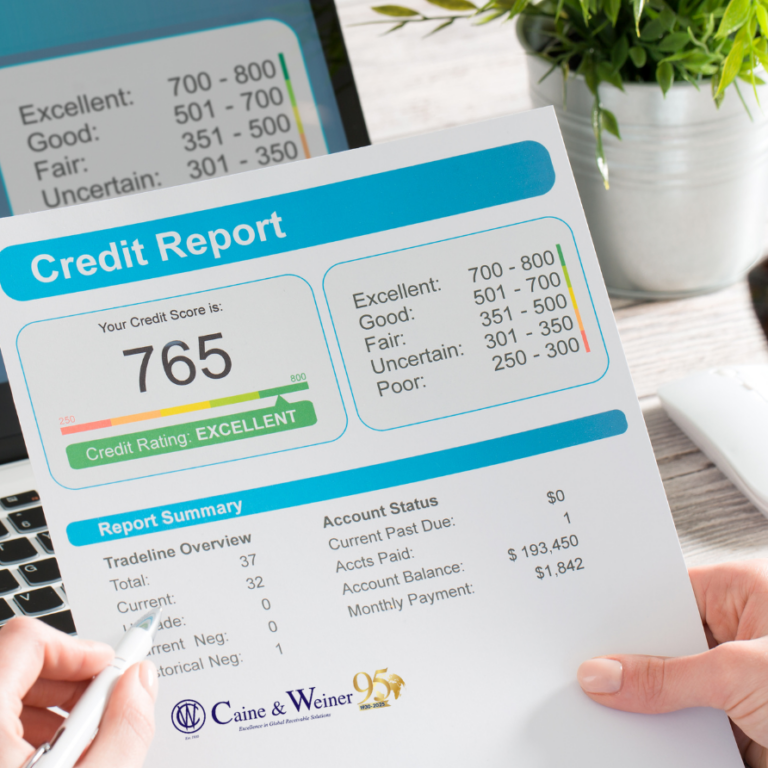

How long until I get a 700 credit score?

If you open a secured card today, keep your utilization low (spend less than 10% of the limit), and never miss a payment, you can realistically debut with a score in the 650–700 range after six months.

Does checking my own credit hurt my score?

No. Checking your own score is a Soft Inquiry. You can check it every day if you want; it will never lower your score.

Can I get a car loan with no credit?

It is difficult. “No credit” is often treated the same as “Bad credit” by auto lenders. You will likely face extremely high interest rates (15%+). It is financially smarter to spend 6 months building credit with a secured card before walking into a dealership.