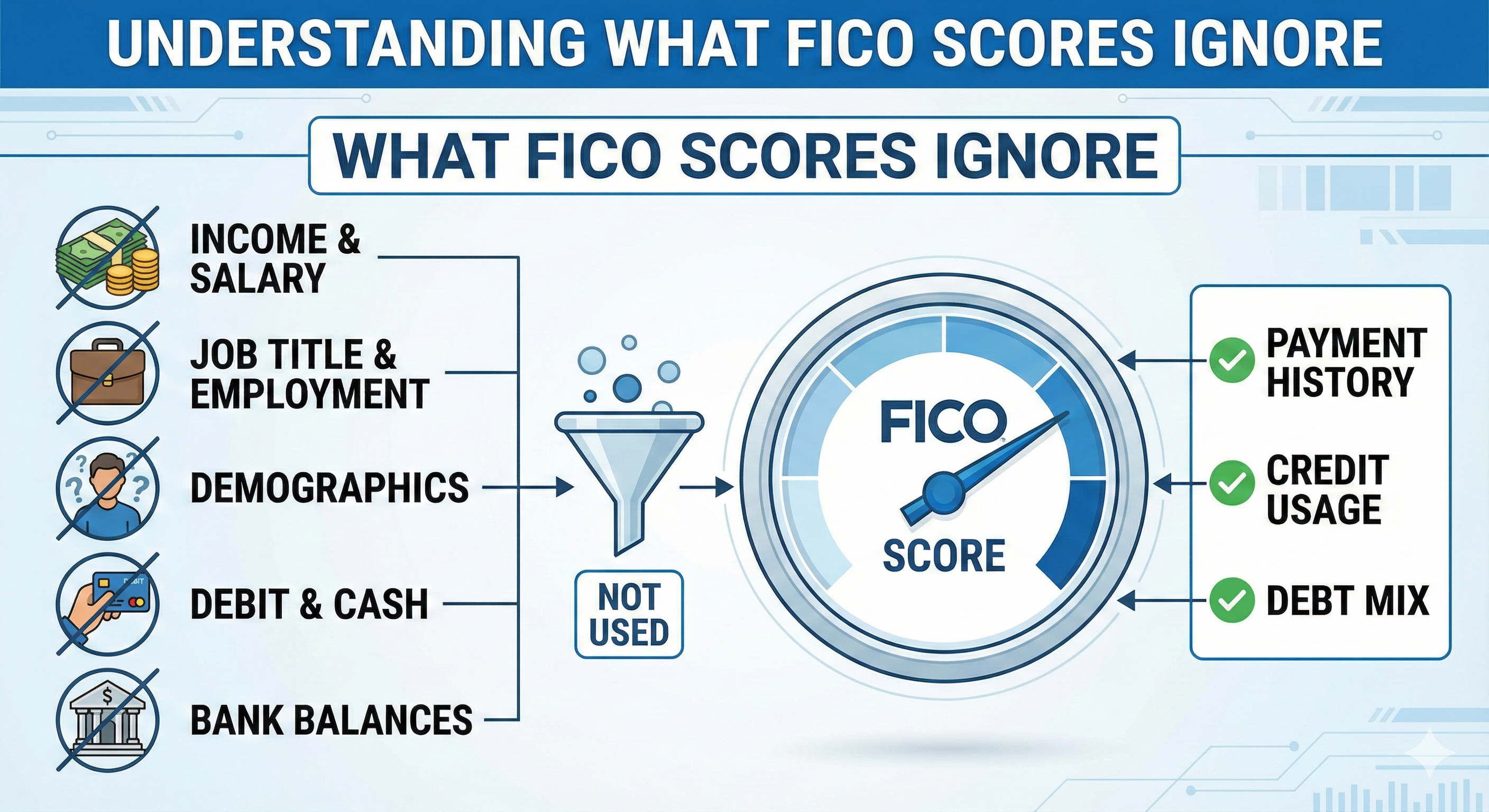

Understanding What FICO Scores Ignore(Income, Job & More)

Your FICO score does not know how much money you make, what your job title is, or how much cash you have in the bank. While these factors are critical for getting approved for a loan, the FICO algorithm completely ignores them because it is designed only to measure your history of managing debt, not your financial wealth.

The Big Misconception: Score vs. Approval

Many people believe a high salary guarantees a high credit score. This is false. You can earn $200,000 a year and have a 500 credit score, or earn $30,000 a year and have an 800 score.

The FICO formula focuses entirely on the data found in your consumer credit report. If information isn’t on that report, it isn’t part of your score.

List: 5 Major Factors FICO Scores Ignore

The following items are never used to calculate your FICO score, regardless of which credit bureau (Equifax, Experian, or TransUnion) supplies the data.

1. Your Income and Salary

Your credit report does not track your earnings. FICO does not know if you got a raise or took a pay cut. Lenders care about your income to calculate your Debt-to-Income (DTI) ratio, but the credit score itself does not factor this in.

2. Employment Status and Job Title

Being unemployed does not lower your credit score. Being a CEO does not raise it. While your employer’s name might appear on your credit report for identification purposes, your length of employment or current job status has zero weight in the scoring algorithm.

3. Your Age, Race, and Gender

Federal law, specifically the Equal Credit Opportunity Act (ECOA), prohibits credit scoring models from considering demographics.

- Age: FICO does not care how old you are, only how old your accounts are.

- Location: Where you live does not impact your score.

- Marital Status: Being married or single does not change your score (unless you open joint accounts).

4. Debit Card and Cash Transactions

Using a debit card does not build credit. FICO scores only look at credit accounts (loans and credit cards). Since debit card usage draws directly from your bank account and does not involve borrowing money, it is invisible to the scoring model.

5. Bank Account Balances

You could have $1 million in a savings account, but if you miss a credit card payment, your score will drop. Credit bureaus do not have access to your checking or savings account balances, so FICO cannot use them.

Comparison: Credit Report vs. Loan Application

It is important to understand the difference between what makes up your Score and what makes up a Lending Decision.

| Factor | Included in FICO Score? | Reviewed by Lenders? |

|---|---|---|

| Payment History | YES (35%) | Yes |

| Credit Card Debt | YES (30%) | Yes |

| Salary / Income | No | Yes (Critical) |

| Employment History | No | Yes |

| Bank Balances | No | Sometimes (Mortgages) |

| Child Support | No* | Yes |

*Note: Child support is only included in your score if you are delinquent and it becomes a derogatory public record or collection.

Why Does FICO Ignore Income?

FICO scores measure risk, not wealth. The algorithm is designed to answer one specific question: “If we lend this person money, how likely are they to be at least 90 days late on a payment in the next 24 months?”

Historical data shows that how you handled debt in the past is a better predictor of future behavior than how much money you earn. A wealthy person who forgets to pay bills is a higher credit risk than a lower-income person who pays automatically every month.

Frequently Asked Questions (FAQ)

Does checking my own bank balance affect my score?

No. Your bank account activity is private. Soft inquiries (checking your own score) and checking bank balances never hurt your credit.

If I get a better job, will my credit score go up?

No. A better job helps you afford payments, which keeps your history clean, but the job title or salary increase itself triggers no change in the FICO number.

Does receiving government assistance hurt my score?

No. Participation in programs like SNAP or unemployment benefits is not reported to credit bureaus and does not affect your credit score.

Can paying rent help if FICO ignores non-debt payments?

Traditionally, rent was ignored. However, newer models like FICO Score 9 and FICO Score 10 can factor in rental payments if your landlord reports them to the bureaus. You often need to use a third-party service to get this data onto your report.