Reported vs Verified rent Explained: Why Rent Reporting Is as Powerful as Loan Payments

When it comes to building credit, most people think of loans and credit cards. But what if your monthly rent payments could count just as much? Increasingly, rent payments are treated similarly to loan payments when reported to credit bureaus—offering a powerful tool for financial inclusion. Yet, there’s a crucial distinction: reported doesn’t always mean verified. Understanding the difference between reported vs verified rent data is key to leveraging this often-overlooked path to creditworthiness.

Millions of renters make on-time payments every month, but without formal reporting, those responsible habits go unnoticed by lenders. However, services that report rent to major credit bureaus like Experian, Equifax, and TransUnion are changing the game. When rent is verified through documentation or third-party validation, it gains the same credibility as a mortgage or auto loan payment.

This article dives deep into how rent reporting works, why verification matters, and how you can turn your rent into a credit-building asset. We’ll explore the systems behind reported vs verified data, compare leading rent-reporting platforms, and reveal strategies to ensure your payment history strengthens your financial profile. Whether you’re new to credit or rebuilding it, this guide will show you how rent can be more than just a monthly expense—it can be a stepping stone to financial freedom.

Why Rent Payments Are Financially Significant

The Hidden Value of On-Time Rent Payments

Rent is not just a housing cost—it’s often the largest and most consistent financial obligation in a person’s budget. For millions of Americans, especially those without credit cards or loans, rent represents their primary demonstration of financial responsibility. Yet historically, this behavior has been invisible to credit scoring models.

According to a 2021 study by the Urban Institute, over 92% of renters pay on time each month—a rate that rivals or even exceeds repayment rates for auto loans and personal loans. Despite this, only about 10% of rent payments are formally reported to credit bureaus. That means the vast majority of responsible renters are missing out on an opportunity to build credit simply because their payments aren’t being tracked.

Imagine someone who pays $1,500 in rent every month for five years with perfect consistency. To a lender, that’s a strong indicator of reliability—yet without formal reporting, it doesn’t appear on their credit report. This creates a paradox: people who avoid debt (a financially smart choice) are penalized for not having a “credit history.”

Rent vs. Loan Payments: A Behavioral Parallel

At their core, both rent and loan payments share key characteristics:

- Fixed monthly amounts

- Consistent due dates

- Consequences for non-payment (eviction vs. repossession)

- Long-term financial commitment

When you pay your car loan, you’re proving you can manage installment debt. The same logic applies to rent. In fact, missing rent often has steeper consequences than missing a credit card payment—like losing your home. That makes timely rent payments a potentially stronger predictor of financial responsibility than some traditional credit markers.

A unique insight? Rent may be a more reliable behavior than credit card usage, which can be manipulated (e.g., carrying high balances, making minimum payments). Rent, on the other hand, is usually a non-negotiable expense.

Real-World Impact on Credit Scores

Take the case of Jamal, a 30-year-old graduate student in Chicago. He had no credit history—never owned a credit card or taken out a loan. But he’d paid $1,200 in rent on time every month for six years. After enrolling in Axcessrent, a service that verifies and reports rent to all three credit bureaus, his FICO Score jumped from 580 to 643 in four months. That increase qualified him for a low-interest auto loan, which he previously couldn’t secure.

Studies back this up. A Consumer Financial Protection Bureau (CFPB) report found that including verified rent data increased credit scores for 76% of thin-file consumers, with average gains between 40 and 65 points.

In short, when rent is verified and reported, it functions just like a loan payment—proving creditworthiness and opening doors to better financial opportunities.

How Rent Reporting Works Today

Third-Party Rent Reporting Services Explained

So how does your rent go from a bank transfer to a line on your credit report? The answer lies in third-party rent reporting services—companies that collect, verify, and submit rental payment data to credit bureaus.

These services act as intermediaries between tenants, landlords, and credit agencies. They don’t replace your landlord’s role but instead validate and formalize your payment history so it meets credit reporting standards.

The most popular platforms include:

- AxcessRent

- RentReporters

- Piñata

- LevelCredit

- ClearNow

- Experian Boost

Each operates slightly differently, but they all follow a similar process: you provide proof of rent payments (bank statements, lease agreement), the service verifies the data, and then reports it monthly to one or more credit bureaus.

There are two main models for rent reporting:

- Landlord-Initiated Reporting: The property owner or management company uses software (like AppFolio or Buildium) that automatically sends tenant payment data to credit bureaus. This method is highly reliable because the data comes directly from the source.

- Tenant-Initiated Reporting: You, the renter, sign up for a service and submit your own payment history. This is more common, especially for individual landlords who don’t use reporting-enabled software.

While tenant-initiated services offer accessibility, they require more effort and documentation. However, they empower renters to take control of their credit building—even if their landlord doesn’t participate.

Integration with Credit Bureaus: Experian Boost & Others

When it comes to boosting your credit score through rent payments, not all rent reporting services are created equal. The key lies in which credit bureaus receive your data—and how that data is verified.

Unlike free or limited tools that may only impact one bureau or VantageScore models, AxcessRent stands out by offering verified, FCRA-compliant reporting designed for maximum impact across multiple scoring

What Makes AxcessRent Different?

- Multi-Bureau Reporting: AxcessRent partners with major credit bureaus for full-spectrum reporting.

- Verified Payments Only: AxcessRent verifies rent directly from landlords or property managers—ensuring the data is trusted and credible to lenders.

- No Hidden Fees: While many competitors charge upfront or ongoing fees, AxcessRent offers transparent, affordable pricing—and in some cases, may even be covered by your landlord.

💡 Unlike free “credit boost” services that only pull rent data from your bank account (and often don’t affect your FICO score), AxcessRent’s approach is fully verified and recognized in credit decisions made by banks, mortgage lenders, and credit card issuers.

Reported vs Verified – What’s the Difference?

Defining “Reported” Rent Data

“Reported” simply means that information about your rent payments has been sent to a credit bureau. It could come from a landlord, a tenant, or an automated system. But reported does not mean accepted or trusted.

For example, if you use a free app to claim you’ve paid rent for two years, that data might appear on your credit file—but without proof, it’s considered unverified. Lenders and underwriters may disregard it during loan reviews.

What Makes Rent Data “Verified”?

Verified rent data has been authenticated using reliable evidence, such as:

- Bank transaction records showing rent payments

- Signed lease agreements

- Landlord confirmation (email, form, or call)

- Property management software logs

Verification ensures compliance with the Fair Credit Reporting Act (FCRA), which governs the accuracy and fairness of consumer data. Without verification, your rent history is just a claim—not a credit asset.

Case Study: Unverified Rent Claims Rejected by Lenders

Meet Lisa, a 25-year-old nurse in Denver. She used a free rent reporting app that claimed to boost her credit. Her Experian score rose by 38 points. But when she applied for a mortgage, the lender pulled her full tri-merge report and noticed the rent data wasn’t verified by a third party. The underwriter disregarded it, and Lisa was denied.

In contrast, David used RentReporters, which required him to upload 12 months of bank statements and get his landlord to confirm his tenancy. His rent history was marked as “verified” on all three reports. He was approved for a car loan at 5.4% APR, saving thousands in interest.

This highlights a critical gap: not all rent reporting services verify data to the same standard. Some only report to one bureau, others don’t meet FCRA requirements, and many don’t notify tenants if a bureau rejects their data.

A 2023 CFPB report found that only 37% of alternative data submissions (including rent) were fully verified and accepted across all three bureaus.

Credit Bureaus and Rent Inclusion Policies

Experian, Equifax, and TransUnion Compared

Each credit bureau handles rent data differently:

- Experian: Leads with Experian Boost, allowing users to add rent, utilities, and telecom payments. Fast and free, but only affects Experian-based VantageScores—not widely used FICO models.

- Equifax: Accepts rent data through partners like ClearNow and CoreLogic. Often used by property managers, less accessible to individual tenants.

- TransUnion: Operates RentBureau, one of the largest rent reporting databases in the U.S., used by over 12 million rental units. Highly credible due to verification standards.

FICO Score Models and Alternative Data

- FICO Score 8: Ignores rent data.

- FICO Score 9: Includes rent if reported through a verified, FCRA-compliant source.

- FICO XD: Alternative model that includes rent and utilities (used by some fintech lenders).

VantageScore 4.0: The Game Changer for Rent

Developed jointly by all three bureaus, VantageScore 4.0 is designed to include alternative data like rent. It’s used by Credit Karma, Capital One, and many fintech lenders. Studies show it’s more responsive to rent reporting, with average score increases of 46 points for thin-file users.

The Impact on Credit Scores: Data and Evidence

Average Credit Score Gains from Rent Reporting

Rent reporting can significantly influence credit scores, especially for those with little or no credit history. Here’s how different levels of rent data reporting affect scores:

- No Reporting: 0 point gain

- If your rent isn’t being reported to the credit bureaus, it has no impact on your credit score. This is the case for most renters in the U.S., unless they enroll in a rent reporting service.

- Reported Only: +22 points (VantageScore)

- When rent is simply reported (but not verified or reported to multiple bureaus), data from VantageScore shows an average score increase of +22 points.

- This increase is due to the positive payment history being added to your credit file, especially if it’s the only or one of the few tradelines.

- Verified & Multi-Bureau: +58–65 points

- Rent that is verified (i.e., confirmed by your landlord or property management) and reported to multiple bureaus (like Equifax, TransUnion, and Experian) can result in a much higher boost—often between +58 to +65 points.

- This reflects greater credibility in the data and wider impact across lenders who may pull from different bureaus.

Long-Term Credit Building with Consistent Rent Payments

- After 12 months of verified rent reporting, many users see a stable and sustained increase in their credit score.

- Consistency signals reliability to lenders. Regular, on-time payments help:

- Improve your payment history—which is a key factor in all credit scoring models.

- Strengthen your credit mix by adding an installment-like account to your profile, even though it’s not a traditional loan.

Bonus: A strong credit mix and longer credit history contribute to higher FICO and VantageScore ratings over time.

Who Benefits Most from Rent Reporting?

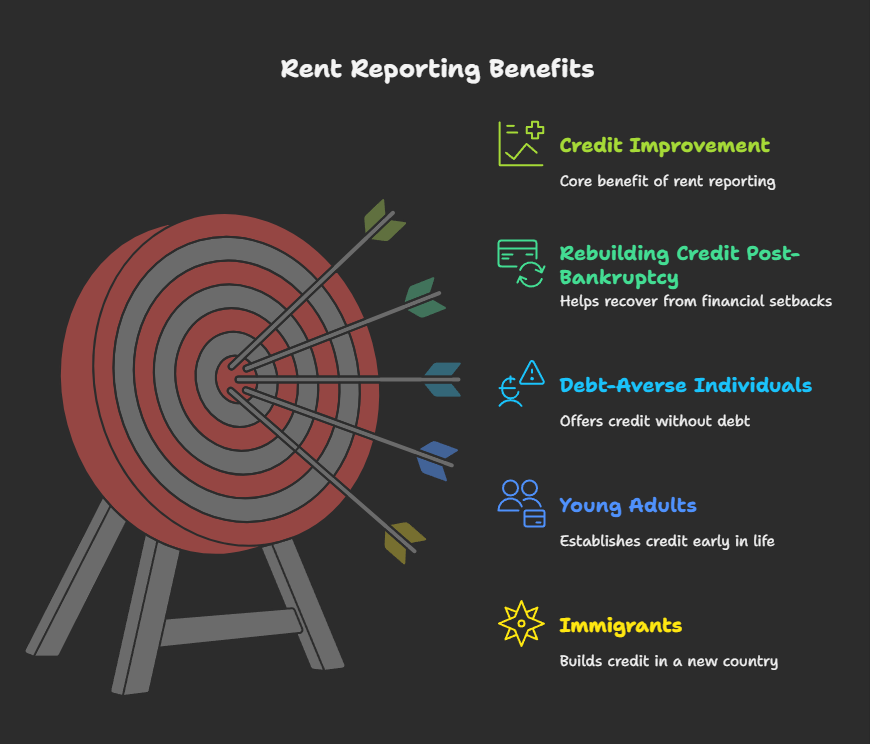

1. Thin-File and No-Credit Consumers

People with limited or no credit history are often called thin-file consumers. For them, rent reporting acts like a shortcut to establishing a strong credit profile without needing credit cards or loans.

2. Immigrants

Many immigrants arrive in the U.S. with no U.S. credit history, making it hard to get approved for housing, credit cards, or loans. Rent reporting can serve as one of the first ways to build domestic credit.

3. Young Adults

College students or those fresh out of school typically lack credit history. Instead of jumping straight into credit cards or auto loans, they can build credit responsibly through their rent payments.

4. Debt-Averse Individuals

People who avoid loans and credit cards might struggle to build a credit history. Rent reporting offers a non-debt path to a healthy credit score, perfect for those who pay rent consistently but don’t want to take on traditional credit products.

5. Rebuilding Credit Post-Bankruptcy

Those recovering from bankruptcy or severe delinquencies often face high interest rates or denial of credit. Rent reporting helps rebuild their credit foundation by:

- Showing responsible payment behavior post-bankruptcy.

- Adding new, positive tradelines without needing to qualify for new credit.

Challenges and Limitations of Rent Reporting

While rent reporting has emerged as a powerful tool to help renters build credit, it’s not without its hurdles. From technical limitations to regulatory compliance, several factors can determine how effective or risky a rent reporting service may be for both tenants and landlords. Understanding these challenges is key to making the most of this financial innovation.

Not All Services Are Created Equal

One of the most important distinctions in the rent reporting space is the quality and legitimacy of the service provider. Many fintech apps and platforms advertise “credit boosts” with minimal upfront explanation. However, not all services adhere to Fair Credit Reporting Act (FCRA) standards.

Services that don’t verify payment data with landlords or fail to report to all three major credit bureaus (Equifax, Experian, and TransUnion) may provide only limited or temporary improvements to your credit score. Worse, some services may report data inconsistently, which can raise red flags on your credit report.

✅ Tip: Always choose rent reporting services that are transparent, FCRA-compliant, and partner directly with landlords or property management systems.

Risk of Disputes and Inaccurate Reporting

Rent data, like any credit data, is subject to human error, system bugs, and delays. Inaccurate rent reporting can occur if:

- Your landlord’s records are outdated

- The rent payment data is misclassified

- The wrong amount or due date is reported

Such errors can lead to lower credit scores, disputes with credit bureaus, and unnecessary stress for tenants. Even when a tenant pays on time, a mismatch in data can reflect as a late payment on their credit profile.

⚠️ Important: According to FCRA, tenants have the right to dispute any inaccurate reporting, but the process can be slow and complicated.

Privacy and Data Security Concerns

When you sign up for rent reporting, you’re often required to share sensitive financial and personal information — including your bank account, lease agreements, Social Security number, and rental history. This makes data privacy a legitimate concern.

Only use platforms that:

- Use SOC 2-compliant security standards

- Encrypt data both at rest and in transit

- Have a strong track record of transparency and user protection

🔐 Best Practice: Before signing up, check the provider’s privacy policy and verify whether they sell or share your data with third parties.

Landlords’ Role in Rent Verification

While tenant-initiated rent reporting is gaining popularity, landlord participation remains crucial to accurate and widespread adoption.

Why Most Landlords Don’t Report Rent

Despite the clear benefits to tenants, most landlords do not report rent payments. The reasons vary:

- Lack of awareness about rent reporting services

- Time constraints and administrative burden

- Limited integration with existing property management tools

Without a streamlined system, many landlords simply don’t see the value or ease in participating.

Incentivizing Landlords to Participate

Encouraging landlords to embrace rent reporting requires strategic benefits. Some of the most compelling incentives include:

- Tax deductions for offering tenant credit-building services

- Improved tenant retention due to stronger credit incentives

- Free or low-cost tools that integrate easily into their workflows

💡 Pro Tip: Services that offer dual-benefit rent reporting (for tenants and landlords) are more likely to gain adoption.

Property Management Software with Built-In Reporting

One major step toward mainstream rent reporting is the integration of credit reporting into property management software. Leading platforms like:

- AxcessRent

- AppFolio

- Buildium

- RealPage

Now offer automated rent reporting features, reducing the workload for landlords and ensuring timely, accurate data for credit bureaus.

This technological evolution is especially important for multi-unit housing complexes and professional landlords who manage hundreds of tenants.

Legal and Regulatory Landscape

The expansion of rent reporting also depends heavily on the legal framework that governs credit data in the U.S.

Fair Credit Reporting Act (FCRA) and Rent Data

Under the FCRA, any rent data that is reported must meet the following requirements:

- Be accurate, timely, and verifiable

- Allow the tenant to dispute inaccuracies

- Be handled by Consumer Reporting Agencies (CRAs) with oversight

FCRA compliance is essential for any service looking to provide lasting, meaningful credit improvements to renters.

State-Level Initiatives Promoting Rent Reporting

Some state governments are taking proactive steps to close the rent-credit gap. For example:

- California: Launched pilot programs that fund rent reporting partnerships for public housing.

- New York: Passed legislation encouraging housing providers to adopt credit-building rent tools.

These efforts aim to institutionalize rent reporting and ensure low-income and marginalized communities have equal access.

Future Trends: Will Rent Become Standard Credit Data?

The question on everyone’s mind: Will rent reporting become the norm by the end of the decade?

Financial Inclusion and Policy Advocacy

Organizations like the Consumer Bankers Association, Urban Institute, and CFPB are advocating for universal rent data inclusion. Their goal is to ensure credit-invisible Americans—those without credit cards or loans—can finally access credit fairly.

Predictions for Universal Rent Reporting

By 2030, many experts predict that rent reporting will be as routine as mortgage data in credit reports. Financial inclusion efforts, AI-powered verification tools, and evolving credit models are accelerating this change.

📈 Conclusion: While not perfect, rent reporting is fast becoming one of the most transformative credit-building tools available today—especially for renters looking to take control of their financial future.

LSI Term Highlight: “Rent as Installment Payment”

As lenders start treating rent more like a structured installment loan (much like auto or mortgage payments), it gives credit models a clearer and more consistent indicator of a tenant’s financial discipline. This concept—”rent as installment payment”—is central to rent reporting’s growing importance.

Conclusion

The way we think about credit is evolving. Rent payments are treated similarly to loan payments when reported—but only when that data is verified. The distinction between reported vs verified isn’t just technical jargon; it’s the difference between a score bump and real financial opportunity.

As we’ve seen, millions of responsible renters are overlooked simply because their payments aren’t formally recognized. But with the right tools—services that provide FCRA-compliant verification, multi-bureau reporting, and integration with modern scoring models—rent can become a powerful credit-building tool.

The future is moving toward inclusion. VantageScore 4.0, FICO Score 9, and policy initiatives are paving the way for rent to be treated like any other installment payment. But until it’s universal, the onus is on tenants and landlords to act.