Best Secured Credit Cards 2026: Build Credit Fast (Even with Bad Credit)

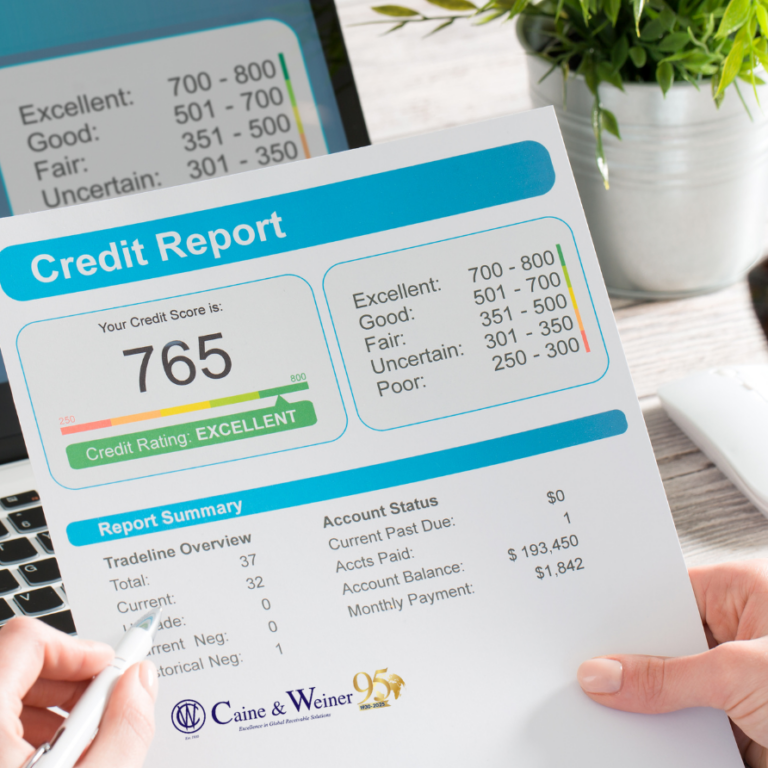

Secured credit cards are the fastest way to build or rebuild credit, requiring only a $200-$500 refundable deposit. Compare the 9 best secured cards of 2026, learn how they work, and discover which one gets you to a 680+ credit score fastest. Most users see 60-100 point increases within 12 months. Bad credit doesn’t have…

What Is a Thin Credit File? (How 62 Million Americans Can Fix Theirs)

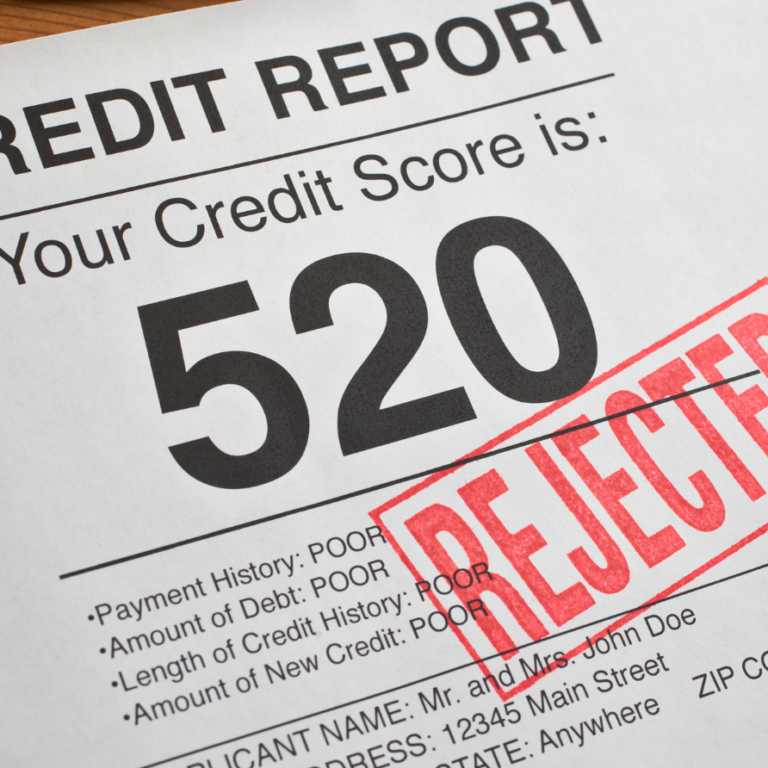

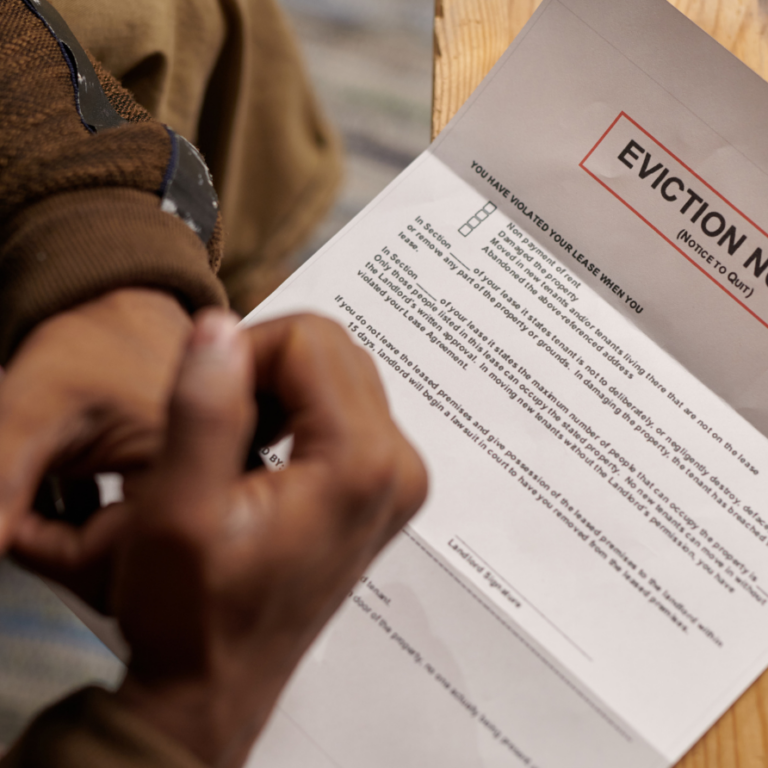

A thin credit file means you have fewer than 5 active credit accounts, making it harder to get loans or good interest rates. Learn what causes thin files, how they affect your credit score, and the 7 proven strategies to thicken your credit profile fast—including rent reporting. You apply for an apartment. The landlord pulls…

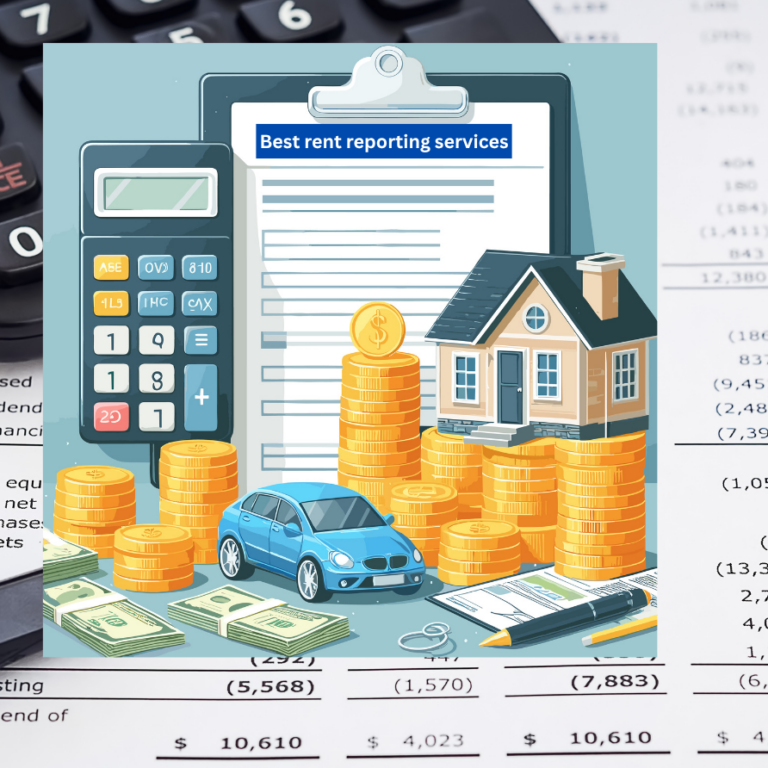

How Rent Reporting Works: The Complete 2026 Guide to Building Credit with Rent Payments

Learn exactly how rent reporting works in 2026, from setup to credit score impact. Discover the step-by-step process, costs, and how to choose the best service. Start building credit with rent payments today. You’ve been paying rent on time for years. Maybe decades. But your credit score? It doesn’t show any of that. Here’s why:…

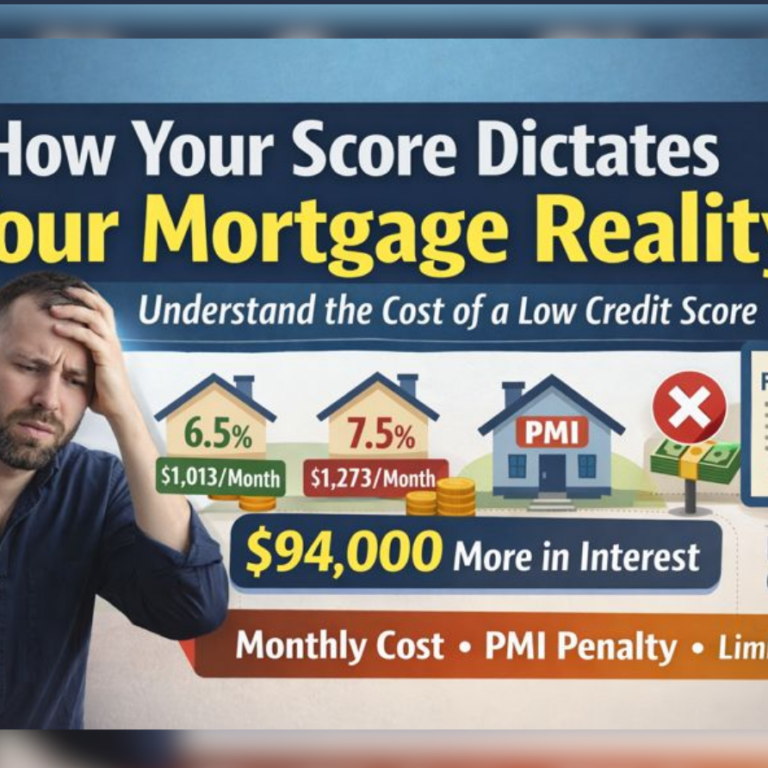

How Your Score Dictates Your Mortgage Reality in 2026 ?

Walking into a bank to secure a home loan feels like a high-stakes interview. You’ve saved the down payment, scouted the neighborhoods, and picked the perfect kitchen layout. But beneath the surface, a invisible three-digit number is doing all the heavy lifting. Your credit score isn’t just a grade; it’s a financial gatekeeper that dictates…

Debt Trap: Meaning, Causes, and the Path to Financial Freedom

In today’s fast-paced “buy now, pay later” economy, the line between healthy credit and a soul-crushing financial cycle is thinner than ever. We often hear the term “debt trap” thrown around in news headlines or financial blogs, but what does it actually feel like when you’re inside one? A debt trap isn’t just a balance…

How Does Debt Relief Work in the US?

The term “debt relief” has become a lifeline for millions of American households. As inflationary pressures and high interest rates persist, understanding how debt relief works in the US is no longer just for those in crisis—it is a critical piece of financial planning. Debt relief is an umbrella term for several strategies designed to…

How to Consolidate Credit Card Debt in 2026?

As we navigate the economic landscape of 2026, many Americans find themselves juggling multiple high-interest balances. With the average US credit card APR hovering between 22% and 24% and total national credit card debt reaching historic highs, the cost of “carrying a balance” has never been more expensive. Credit card debt consolidation is the process…

Secured Debt: The Complete Guide to Collateral, Risks, and Financial Strategy

In the world of personal finance, debt is generally divided into two camps: secured and unsecured. Understanding the nuances of secured debt is critical because the stakes are inherently higher. When you take out a secured loan, you aren’t just promising to pay the money back; you are legally pledging an asset as a guarantee….

Debt Settlement: Complete Guide, Costs & Risks

Debt is more than just a financial metric; it is a psychological weight that affects every facet of daily life. When your monthly obligations exceed your take-home pay, or when high interest rates make it impossible to touch the principal balance, you need a radical exit strategy. Debt settlement is that strategy—a high-stakes negotiation that…

Which statement best describes how an investor makes money off debt?

If you are looking for the shortest, most accurate answer, it is this: An investor makes money off debt by acting as a lender, collecting regular interest payments (the “coupon”), and receiving the return of their original principal at a later date. While equity investors (stock buyers) make money through company growth and dividends, debt…

How much debt to file chapter 7 bankruptcy ?

If you are looking for a specific “magic number” in the law books that says “You must owe $15,342 to file for bankruptcy,” you aren’t going to find it. The law doesn’t actually set a minimum amount of debt. Technically, you could file Chapter 7 over a $500 phone bill, but that would be a…

Good Debt vs. Bad Debt: Mastering the Ratios of Financial Health

Let’s be honest: the word “debt” usually feels like a four-letter word. We’ve been told since we were kids that owing money is a failure. But if you look at how the world’s wealthiest people operate, you’ll notice they aren’t debt-free—they are debt-literate. The secret isn’t just avoiding “the red.” It’s understanding the nuance of…

Guide to Debt Management Options: Mastering Your Finances

Debt is rarely just a numbers game; it is an emotional and psychological weight that can paralyze even the most disciplined individuals. In a world where “buy now, pay later” is the default setting of the economy, falling into a debt trap isn’t a sign of failure—it’s a systemic inevitability for many. However, staying in…

What Are Target Date Funds?

Understanding the Basics of Target Date Funds If you have ever looked at your retirement account and felt like you were staring at a cockpit of a jet plane, you are not alone. Investing can feel super complicated. But there is one specific type of investment designed to make things easy for everyone. It is…

Investment Risk Tolerance Explained: Know Your Limits

Investment risk tolerance is not a static number; it is a fluid psychological and financial boundary that shifts as you move through different seasons of life. Whether you are a fresh graduate entering the workforce or a professional eyeing the finish line of retirement, your ability to endure market volatility is governed by two distinct…

What are common investing mistakes to avoid?

In the world of finance, winning isn’t about being the smartest person in the room; it’s about being the person who makes the fewest catastrophic mistakes. Whether you are a beginner in the United States looking to open your first Roth IRA, a seasoned real estate pro, or a Web3 founder navigating the volatility of…

What Is a 401k? Know Working, Contribution Limits, and Withdrawal Rules

If you’re staring at a stack of HR paperwork and wondering where your paycheck is going, you’re in the right place. The 401k is the “gold standard” of American retirement, but it’s also wrapped in enough red tape to confuse a CPA. Let’s strip away the fluff and answer your most pressing questions with zero…

Everything You Need to Know About Roth IRA

If you’re reading this, you’ve probably heard that a Roth IRA is a “good idea.” That is a massive understatement. In the world of finance, where every bank and government agency is trying to take a slice of your pie, the Roth IRA is one of the few places where you get to keep the…

The Guide to Investing: Building Wealth Without Fluff

Let’s be honest: most “Guide to Investing” are boring. They’re filled with dry definitions that make your eyes glaze over before you even get to the part about making money. But here’s the reality—if you aren’t investing, you’re essentially watching your savings melt away thanks to inflation. Investing isn’t just for people in suits on…

What Does Homeowners Insurance Cover?

Understanding your homeowners insurance policy is the difference between a covered repair and a financial disaster. Most standard policies (HO-3) are “open peril” for your dwelling, meaning you are covered for everything except what is specifically excluded. Here is the breakdown of what your insurance covers, based on the most common claims and homeowner concerns….

what is Homeownership Rate in US ? Rates by different state

When we look at the health of the American economy, the homeownership rate is often the most telling pulse. Is the “American Dream” still attainable, or is the nation shifting toward a permanent renter class? Using the latest data from USAFacts and the U.S. Census Bureau, we can break down where we stand today. 1….

Am I Ready to Buy a House? A 2026 Roadmap

The moment I stopped looking at houses as “dreams” and started looking at them as “debt-to-income equations” was the moment I actually became ready to buy. Most people approach homeownership with a “Zillow-first” mindset. They fall in love with a kitchen island before they’ve even checked their FICO score. But if you want to avoid…

5 Ways Credit Counseling Can Help You Buy a Home?

The journey to homeownership is often viewed through the lens of open houses and aesthetic renovations. However, for the millions of Americans navigating the “credit gap,” the reality is much more clinical. It is a world of FICO scores, Debt-to-Income (DTI) ratios, and the looming fear of a “denied” notification from a mortgage underwriter. If…

Is homeownership worth it ?how to prepare for it ?

Let’s get one thing straight: the “American Dream” narrative is a marketing masterpiece. We’re told that buying a house is the finish line of adulthood, a golden ticket to stability, and a foolproof way to get rich. But if you’ve ever sat in a basement at 2:00 AM while a pipe mimics a geyser, you…

FAFSA Mistakes to Avoid: Stop Losing Free College Money

The Free Application for Federal Student Aid (FAFSA) is the single most important document in a student’s journey toward an affordable college education. Every year, billions of dollars in federal grants, work-study funds, and low-interest loans are distributed based on the data provided in this form. However, billions more are left on the table because…

Can you use a HELOC to pay off student loans ?

Introduction Student loan repayment decisions are rarely neutral choices; they reshape household balance sheets for decades. As outstanding education debt remains high and repayment periods lengthen, some borrowers consider using housing wealth to resolve obligations originally incurred for schooling. Among the options discussed in personal finance and policy circles is the use of a Home…

Does Student Loan Debt Affect Your Credit Score?

Understanding how student loan debt affect your credit score is a critical step in modern financial literacy. Whether you are a current student, a recent graduate entering repayment, or a parent co-signer, your student loan behavior is one of the most significant factors in determining your “creditworthiness.” In this comprehensive guide, we will explore the…

Federal vs Private Student Loans: A Complete Financing Guide

Let’s be real for a second. If you’re reading this, you’re probably sitting at your kitchen table with a stack of papers from the financial aid office, feeling like you need a math degree just to understand how to pay for your degree. Maybe you’re a parent trying to help your kid avoid the “debt…

How College Financial Aid Works and How to Qualify?

The cost of higher education has outpaced inflation for decades, transforming the search for financial aid from a simple paperwork exercise into a high-stakes strategic operation. To navigate this landscape successfully, one must move beyond a surface-level understanding and master the three pillars of funding: Grants, Scholarships, and Loans. This guide provides an exhaustive analysis…

How to start saving money as a college student ?

Financial independence often feels like a distant goal when you are balancing exams, social lives, and entry-level internships. However, the financial habits formed during your college years are the most critical predictors of your future wealth. For a student, the question isn’t just about how much money you have in your pocket today, but how…

What Document Explains Your Rights and Responsibilities as a Federal Student Loan Borrower? (It’s the MPN)

College. A life-changing decision, no doubt about it. But then you spotted that tuition number, huh? Instantly, your stomach dropped: “How in the world am I ever going to afford *that*?” Don’t worry, friend. You’re genuinely not alone in that immediate panic. Most folks certainly aren’t sitting on a secret stash of tens of thousands,…

Personal Finance for College Students: Guide to Managing Money, Credit, and Debt

College is a unique financial window. For most students, it is the first time they manage a significant sum of money—whether from financial aid, scholarships, or a part-time job—without a direct safety net. However, the financial habits formed during these four years often dictate the trajectory of your adult life. A single mistake, such as…

10 Best Auto Loan Companies in the United States

Navigating the landscape of vehicle financing in the United States requires more than just looking for the lowest monthly payment. Whether you are purchasing a brand-new electric vehicle or a reliable used car, the lender you choose determines your long-term financial health. This guide provides an exhaustive look at the top auto loan companies, the…

What Happens After Car Repossession? Timeline, Credit Impact, and Next Steps

A vehicle or car repossession is a significant financial setback, but it is not a permanent barrier to vehicle ownership or financial stability. Understanding the timeline of the process and the mechanics of credit recovery is the first step toward getting back behind the wheel. 1. How Does Repossession Work? Repossession occurs when a borrower…

First-Time Auto Loan Requirements: What Lenders Look For

Securing your first auto loan is a significant financial milestone, but for many, it feels like a “Catch-22”: you need credit to get a loan, but you need a loan to build credit. However, lenders—especially credit unions—have specific frameworks designed to help first-time buyers enter the market safely. This guide will walk you through the…

How Lenders Evaluate Risk: Credit Utilization, Refinancing, and Secured Loans Explained

Introduction: Why Risk Matters to Lenders In the financial world, risk is everything. Every loan or credit card approval is essentially a calculated bet on a borrower’s future behavior. Lenders make money only when borrowers repay both the principal and interest as agreed. When a borrower defaults, the lender doesn’t just lose profits—it can lose…

Auto Loan Finance: Guide to Smart Financing

Introduction: The Significance of the Auto Loan For the vast majority of consumers, a vehicle is the second most expensive purchase they will ever make, trailing only the purchase of a home. However, while mortgage processes are highly regulated and standardized, the auto finance industry is a complex landscape of varying interest rates, hidden fees,…

Best Budgeting Tools in 2026: Goal-Based, Family, and Business Solutions

The financial landscape of 2026 has moved far beyond the simple spreadsheet. As we navigate a global economy defined by high-interest rates, fluctuating inflation, and the “subscription-infixation” of every service, the tools we use to manage our money must be more sophisticated than ever. Today, budgeting is no longer just about tracking what you spent;…

How to Create Your Dream Life Through Budgeting ?

Most people view the word “budget” as a financial straightjacket—a restrictive list of “no’s” that prevents them from enjoying life. But what if a budget wasn’t about limitation? What if, instead, it was the blueprint for your dream life? To create your dream life isn’t about winning the lottery; it’s about intentionality. It is the…

How to Budget for What Matters: Values-Based Spending

We’ve all been there: you look at your bank account at the end of the month and wonder, “Where did it all go?” Most traditional budgets feel like a financial diet—restrictive, boring, and prone to failure. But what if your budget wasn’t about saying “no” to everything, but saying “yes” to the things that actually…

Why Your Budget isn’t Working ? 7 Common Mistakes & Solutions

It is a familiar cycle: you spend hours meticulously categorizing expenses, setting limits, and building spreadsheets, only to find that by the middle of the month, the plan has fallen apart. If your budget feels more like a source of stress than a tool for freedom, you aren’t alone. Most budgets fail not because of…

Budget vs. Forecast: Understanding the Critical Differences

In the world of finance, the terms “budget” and “forecast” are often used interchangeably by laypeople. However, for a business owner, CFO, or serious investor, they represent two distinct tools with vastly different purposes. While a budget acts as the blueprint for where you want to go, a forecast is a reality check on where…

What is Zero-Based Budgeting? Complete Implementation Manual

In traditional budgeting, many organizations simply take last year’s spending and add a small percentage for inflation. Zero-Based Budgeting (ZBB) flips this script entirely. It is a rigorous financial strategy where every single expense must be justified for each new period, starting from a “zero base.” Whether you are a corporate finance professional or an…

What is Cash Flow? Strategies to Improve Liquidity

In the world of finance, there is an old adage: “Profit is an opinion, but cash is a fact.” While a business can report a profit on its income statement, it can still go bankrupt if it doesn’t have the liquid capital to pay its bills. This guide breaks down everything you need to know…

How to Create and Maintain a Budget: A Step-by-Step Guide

Introduction At its core, budgeting is simply the process of creating a plan to spend your money. It is an itemized summary of your expected income and expenses over a specific period. Many people view a budget as a “financial diet” that restricts freedom, but the opposite is true: a budget is a tool that…

How to Get Approved for a Loan ?Guide to Home, Car, and Personal loan

Securing financing—whether it’s for a new home, a vehicle upgrade, or consolidating high-interest debt—can feel like navigating a complex maze. But the loan approval process, while specific to the type of loan you seek, relies on a universal set of financial principles. Lenders evaluate risk, and your preparation determines whether you are deemed a safe…

Credit Smart: Guide to Credit Scores, FICO, and Loan Qualification

Whether you’re looking to secure your first major loan, refinance a mortgage, or simply need to improve your financial standing, mastering your credit is essential. Your credit profile is the gatekeeper to major financial opportunities, influencing everything from the interest rate on your car loan to the rent you pay for an apartment. In this…

Account Fundamentals: Mastering Checking Accounts for Financial Control

Managing your money effectively begins with mastering your checking account. This account is more than just a place to hold cash; it is the central operational hub for your entire financial life, facilitating payments, tracking spending, and helping you avoid bank fees. This ultimate guide will break down the essential functions of a checking account,…

Checking vs Savings Account: Differences in Fees, Interest, and Balances

Effective financial management hinges on using your checking and savings accounts for their distinct, intended purposes. While both accounts hold your money, one is a dynamic spending tool while the other is a static, protected growth engine. Misunderstanding this relationship is the easiest way to lose money to unnecessary fees in your checking account, or…

Does Opening a Checking Account Affect Your Credit Score?

It’s one of the most common questions people ask when starting their financial journey: “Does opening a checking account affect your credit score?” The short answer is: No, opening a checking account does not directly impact your credit score. However, the longer and more important answer is that the process of opening and managing a…

Managing Your Checking Account Like a Pro

Few financial mistakes are as instantly punitive and costly as banking errors. A single missed calculation or forgotten auto-pay can result in a Non-Sufficient Funds (NSF) fee—a $35 penalty, often compounded by a matching fee from the payee. These are the high costs of poor banking habits. Learning managing checking account best practices is essential…

What is consolidate debt and How Does it Work?

For many people, the path to financial freedom is littered with high-interest credit cards, multiple personal loans, and scattered monthly payments. It can feel overwhelming and impossible to track. This is where consolidate debt enters the picture. Consolidation is the act of wrapping several smaller debts into one single, larger debt, often with a different…

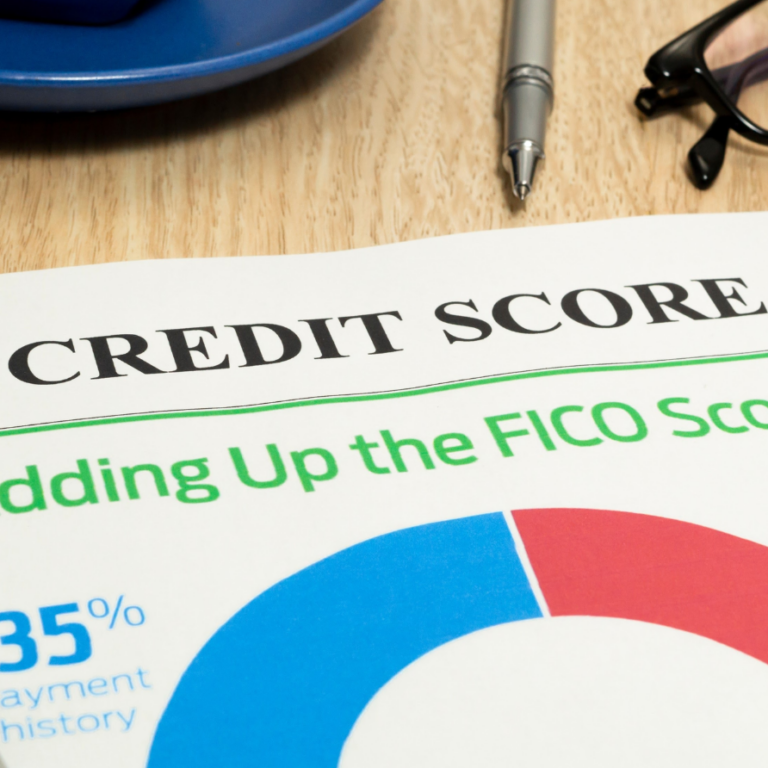

How to Fix and Improve Your Credit Payment History ?

Credit Payment history is the most important component of your FICO Score, making up a massive 35% of the total calculation. Because it acts as the primary indicator of your financial reliability, perfecting this section of your credit report is the fastest and most effective way to raise your score into the excellent range (750+)….

What is Debt Re-Aging? An Easy Guide to the 7-Year Credit Rule

For anyone grappling with old, unpaid bills, the clock is your friend. Debts are governed by strict timelines. They become time-barred (meaning a collector cannot sue you) and must eventually fall off your credit report. Debt Re-aging is the predatory and often illegal practice of manipulating a debt’s age to restart these clocks. It’s a…

Debt Snowball vs Debt Avalanche: Which Method is Better?

If you are serious about becoming debt-free, you have likely encountered the two titans of debt payoff strategy: the Debt Avalanche and the Debt Snowball. Both methods focus on creating momentum by making minimum payments on all debts while aggressively targeting one debt at a time. However, their fundamental approaches are completely different, forcing you…

Does a mortgage inquiry affect credit score ?

You know you need to shop around for the best mortgage rate, but every time a lender pulls your credit, you fear your FICO score will plummet. This fear is rooted in a fundamental misunderstanding of how the credit scoring system handles rate shopping for major loans. The short answer is: Yes, a mortgage inquiry…

New FICO Score Model: When Will the New FICO Score Take Effect?

The credit scoring landscape is shifting. For over a decade, the FICO Score 8 model has been the industry standard for most consumer lending (credit cards, personal loans). Meanwhile, the mortgage industry still relies on decades-old versions (FICO 2, 4, and 5). However, New FICO Score has been steadily rolling out its next-generation models, namely…

FICO Score Versions: which is used for mortgage ?

You check your credit score on your banking app, and it says 720. You go to buy a car, and the dealer tells you your score is 705. You apply for a mortgage, and the lender says your middle score is 680. You are not crazy, and the system isn’t broken. You just have different…

How Much Can I Borrow? (Math Behind Loan Approvals)

When you ask, “How much can I borrow?”, you might think the answer depends entirely on your credit score. You might assume that a 700 score unlocks a specific dollar amount, like a video game level. In reality, your credit score determines the interest rate you pay. It is your income and existing debt that…

Found an Error on Your Credit Report? Here’s What to Do

Discovering a mistake on your credit report is terrifying. Whether it is a stranger’s credit card listed under your name or a bill you paid three years ago showing up as “unpaid,” these errors can unfairly tank your credit score by 50 to 100 points. You are not alone. A study by the Federal Trade…

Does Getting a New Credit Card Hurt Your Credit Score?

Yes, getting a new credit card will likely lower your score by 5 to 10 points temporarily. However, this drop is usually short-lived. In the long run, opening a new card is one of the most effective ways to help your credit score grow higher than it was before. It sounds contradictory, right? How can…

How to Build Credit from Scratch ? Beginner’s Guide

Trying to build credit for the first time feels like a catch-22: You need credit to get a credit card, but you need a credit card to build credit. If you have never borrowed money, you are what the industry calls “Credit Invisible.” This does not mean you have a bad score (like 300); it…

Length of Credit History: What Is a “Good” Credit Age?

When you check your credit score, you might see a grade for “Length of Credit History” (also called Credit Age). While it isn’t the biggest factor in your score—it accounts for 15% of your FICO score—it is often the hardest to improve because you cannot “buy” time. You simply have to wait for it. However,…

What Is Payment History and It’s importance for Credit Score

If your credit score were a house, your Payment History would be the foundation. It is the single most important factor determining your creditworthiness, making up the largest percentage of both FICO and VantageScore models. A pristine payment history signals reliability and responsibility, granting you access to the best interest rates. Conversely, a single late…

FICO Score vs Credit Score: Understanding the Difference

If you have ever applied for a mortgage, taken out a car loan, or even rented an apartment, you have likely been told that your decision hinges on your credit score. Yet, when you check your credit through your bank or a monitoring service, you are often presented with a number labeled FICO Score. This…

How to Lock Your Credit (And When to Use a Freeze Instead)

Locking your credit is the fastest way to block lenders from accessing your credit report. Unlike a “Freeze,” which acts like a permanent security anchor, a Credit Lock acts like a light switch. You can flip it “on” and “off” instantly using a smartphone app, making it perfect for active shoppers. However, locking your credit…

How Is Credit Score Calculated for Married Couples?

The short answer: It isn’t. There is no such thing as a “joint credit score.” When you get married, your credit scores do not merge, average out, or combine. You keep your own score, and your spouse keeps theirs. However, marriage does affect your borrowing power in specific ways. While your scores remain separate, your…

What Is the Lowest Credit Score you can have ?

The lowest credit score you can have is 300. This applies to both the FICO® Score and VantageScore® models, which range from 300 to 850. Despite common myths, it is impossible to have a credit score of zero; if you have no credit history at all, you are simply “unscorable” or “credit invisible,” meaning you…

Understanding What FICO Scores Ignore(Income, Job & More)

Your FICO score does not know how much money you make, what your job title is, or how much cash you have in the bank. While these factors are critical for getting approved for a loan, the FICO algorithm completely ignores them because it is designed only to measure your history of managing debt, not…

Why Your FICO Score Breakdown Looks Different From the Chart ?

You might be looking at your credit report wondering why a single late payment dropped your score by 50 points when the standard chart suggests it is just one piece of the puzzle. The reason your personal score breakdown looks different from the generic FICO pie chart is that FICO uses distinct “scorecards” to grade…

How to Get Caine & Weiner Off Your Credit Report

Caine & Weiner is a real debt collection agency that reports unpaid debts to Experian, Equifax, and TransUnion. A collection account from them can drop your score 50–150 points and stay on your report for 7 years. You can get it removed only if the debt is wrong, outdated, or if they agree to delete…

Why Does Everything in Adult Life Require a Credit Score?

Your credit score is now the main way companies predict if you’ll pay bills on time. It started with loans and cards but spread everywhere because it’s cheap, fast, and automated. Landlords, employers, utilities, and insurers use it to lower their risk — even if it feels unfair. When Did Credit Scores Start Controlling Everything?…

What Happens If You Break an Apartment Lease ?

Breaking a lease means ending it early without legal grounds like uninhabitable conditions. You remain responsible for rent until the unit is re-rented or the lease ends, plus fees and possible eviction. Many tenants reduce damage by negotiating or using rent reporting to keep their rental history clean. What Counts as Breaking a Lease? You…

How Many Noise Complaints Does It Take to Get Evicted?

No fixed number of noise complaints automatically triggers eviction across the US. Landlords must prove a repeated nuisance after written warnings, and most states allow eviction filings after 2–4 documented violations. Strong on-time rent history via rent reporting often makes landlords hesitate to evict paying tenants. What Does a Typical Lease Say About Noise Complaints?…

What is Compound Interest? A Step-by-Step Guide to Growing Your Money

Compound interest is one of the most powerful tools in personal finance and investing. It’s often called “the eighth wonder of the world” because of the incredible effect it has on growing your wealth over time. Understanding compound interest is essential for anyone who wants to make their money work for them, whether you’re saving…

Add Rent to Your Credit Score: The Renter’s Credit Hack

For years, paying rent didn’t count toward your credit score — even if you paid on time every single month. That’s changing fast. With rent reporting services, tenants can now use their largest monthly expense to help build credit, qualify for loans, and show financial reliability. If you’ve ever wondered whether paying rent helps your…

What Is Mortgage Recasting and How Does It Work?

What Is Mortgage Recasting? Mortgage recasting is a method that allows you to reduce your monthly mortgage payment by making a large one-time payment toward your loan’s principal. Once that payment is applied, your lender recalculates the remaining balance over the original term of the loan, which lowers your monthly payment. Unlike refinancing, a recast…

What Are Medium Term Rentals? How Landlords Can Profit

What Is a Medium Term Rental ? A medium term rentals, sometimes called a mid-term rental, is a housing arrangement where a property is leased for a period between one month and one year. It fills the gap between short-term rentals, such as vacation stays, and long-term leases that usually last a year or more….

DIY Credit Repair: Fix Your Credit Score the Smart Way

If your credit score has taken a hit, you’re not alone. Millions of Americans are rebuilding their credit after facing financial setbacks, whether it’s late payments, high balances, or unexpected life events. The good news? You don’t need to pay thousands to a “credit repair company” to fix it. You can repair your credit yourself…

Debt Validation Letter: What It Is and How to Write One

Introduction You get a letter or phone call saying you owe money — maybe for an old credit card, medical bill, or loan you barely remember. Panic sets in. But before you pay a dime or agree to anything, you have the right to ask one simple question: “Can you prove I actually owe this…

How to Settle Tax Debt with the IRS: A Complete Guide

Owing money to the IRS can feel overwhelming. The letters, the penalties, and the fear of wage garnishment can make anyone anxious. But here’s the truth — the IRS actually wants to work with you to resolve your tax debt. The key is knowing your options and acting fast before the situation grows worse. Learn…

My Credit Score Dropped for No Reason — Common Hidden Causes Revealed

If you’ve ever opened your credit app and noticed your credit score dropped — sometimes by 50 or even 100 points — without any warning, you’re not alone. It’s unsettling, especially when you’ve been paying your bills on time and keeping your balances low. But here’s the truth: credit scores don’t just fall “for no…

Does Your Credit Score Matter When Renting a Home?

Introduction When you start looking for a new home or apartment to rent, one of the first questions that might cross your mind is, “Does Your Credit Score Matter When Renting a Home?” You’re not applying for a loan, you’re simply renting a place to live—so why would a number on a credit report make…

How can i fix my bad credit?: Step-by-Step Guide

You miss a few payments, lose track of bills, or hit a rough patch, and suddenly, every lender sees you as a risk. You get denied for credit cards. Auto loans come with sky-high interest. Even apartment applications get tricky. If you’ve ever caught yourself typing “Fix My Bad Credit” into Google at 2 AM…

How do i remove charge off from my credit?

Introduction A charge-off on your credit report can stop you cold. It shows up like a red flag when you apply for a loan. Or try to rent a place. Or even get a better job that checks credit. That one word—”Remove Charge Off Without Paying”—carries a lot of weight. It makes you look risky…

Accrued Expenses, Interest, and Revenue: A Clear Guide to Accrual Accounting

1. What Does “Accrued” Mean? In simple terms, “accrued” means built up over time.When you hear “accrued expenses,” it means the expense has happened, but you haven’t yet paid for it.When you hear “accrued revenue,” it means you’ve earned income, but you haven’t yet received the cash. For example: Accrued items help accountants record transactions…

What Is a Consumer Statement on Your Credit Report? Better Financial Understanding

Introduction Your credit report tells the story of your financial life — how you borrow, repay, and manage debt. But sometimes, numbers don’t tell the full story. Maybe you missed a payment because you lost your job, went through a health crisis, or faced identity theft. In those moments, a consumer statement can be your…

Normal Wear and Tear in a Rental: What Every Tenant and Landlord Should Know in 2025

Introduction When you’re renting a home or apartment — whether you’re the tenant or the landlord — one key question always arises: What is “normal wear and tear in a rental” and how is it different from damage I’m responsible for?This matters a lot: it affects security deposit refunds, what repairs must be done, and…

What Kind of Credit Inquiry Has No Effect on Credit Score?

Introduction When it comes to your credit report and credit score, not all inquiries are created equal. Many people worry that every time someone checks their credit, their score drops. The truth is more reassuring: there are types of credit inquiries that do not affect your credit score. Understanding this distinction can empower you to…

Red Flags That Lenders Look for on Your Credit Report in 2025

Introduction Lenders rely heavily on your credit report when deciding whether to approve you for loans—be it for a mortgage, car, or personal credit. This report provides a detailed snapshot of your financial behaviors and history. Lenders scan it for warning signs, or red flags, that suggest you might struggle to repay. In 2025, regulatory…

How to Remove Late Payments from Your Credit Report

Introduction Late payments show up on your credit report when you miss a bill by 30 days or more. They can drop your score fast. One late might cut it by 60 to 100 points. If your score was good, the hit feels bigger. Lenders look at these marks. They charge higher rates or say…

What Is a Credit Reference? Full Guide for Renters

What Is a Credit Reference? A credit reference is proof that you consistently pay your bills or rent on time. It usually comes from a previous lender, landlord, or service provider who can verify that you met your financial obligations without issues. In simple terms, it’s a character-based record of financial reliability. For renters, it…

How Does the Fair Credit Reporting Act Protect You?

The Fair Credit Reporting Act covers your credit reports. It started in 1970. It makes sure info is accurate. It stops misuse. Bureaus like Equifax and TransUnion must follow it. You get free reports. You can fix errors. It fights theft too. In 2025, changes help with medical debt. And privacy. This guide tells all….

How to Check If My Credit Is Frozen ?

Credit frozen meaning A credit freeze locks your credit report so nobody can open new accounts in your name. You turn it on for free at Experian, Equifax, and TransUnion whenever you want. When it’s frozen, lenders can’t pull your credit, so thieves get denied even if they have your info. You just lift the…

How to report positive rent payment to credit bureau ?

Introduction Rent takes a big chunk of most people’s income. Yet, it often does not help build credit. This changes with positive rent reporting. It lets on-time rent payments show up on credit reports. This helps renters create or boost their credit scores. Many renters lack credit history. About 45 million Americans are credit invisible….

What Revolving Credit ?: Pros, Cons, and Easy Management

Introduction Revolving credit shows up in many wallets. It powers credit cards and lines of credit. People use it for daily buys or emergencies. But it can help or hurt your finances. This guide explains revolving credit. We cover what it is. How it works. Types you might see. Differences from other credit. Effects on…

How to write a goodwill letter ?

Introduction Late payments can hurt your credit score for years. They show up on your credit report and make it hard to get loans or good rates. But you can fight back with a goodwill letter. This simple tool asks creditors to forgive a one-time slip-up. In this guide, we cover everything you need to…

How to Get Free Credit Reports From all 3 Bureaus

Introduction Your credit report holds key details about your money life. It lists loans, payments, and debts. Lenders check it before approving credit. Errors here can raise rates or block approvals. Good news: You can get free reports weekly from the all three bureaus. This started as annual but turned weekly for good in 2023….

How long does bankruptcy stay on your credit ?

Filing for bankruptcy is a significant financial decision, often taken as a last resort to gain relief from overwhelming debt. It’s natural to be concerned about the long-term consequences, especially its impact on your credit. The most common question people have is, “How Long Does Bankruptcy Stay on Your Credit Report?” The short answer is…

Why did my credit score drop ? Common Traps and solutions

Introduction You check your credit score and see it’s lower than last time. It’s frustrating, especially if nothing seems wrong. Credit scores can drop for many reasons, some obvious, others not. In 2025, with high interest rates and economic pressures, scores are falling faster than usual. Gen Z has seen the biggest drops, often from…

Average Credit Score by Age in 2025: Compare and Improve Yours

Introduction Your credit score shapes your financial life. It determines loan approvals, interest rates, and even job opportunities. In 2025, many ask: what’s the average credit score by age? Understanding this helps you see where you stand and how to improve. Scores generally increase with age due to experience, income stability, and better financial habits….

what is debt consolidation ? How does it works ?

Introduction Many people struggle with multiple debts from credit cards, loans, or medical bills. These debts can pile up, making it hard to keep track of payments and interest rates. Debt consolidation offers a way to combine these debts into one single payment, which might simplify your financial life. But a common question arises: does…

How much to save for retirement? Average Retirement Savings Tips

Retirement savings, It’s something we all think about. But how much is enough? The average retirement savings by age gives a benchmark. It helps you see if you’re on track. In 2025, with inflation at 3-5% and living costs up, these numbers matter more. People search for this a lot. They want to know if…

How to Lower My Bills: 12 Proven Ways to Save Money

Bills can feel like a never-ending burden, especially in 2025 when costs keep climbing. With inflation hitting 3-5% and the average rent in the U.S. reaching $1,730 a month according to Apartment List, it’s tougher than ever to keep your finances in check. Whether you’re a renter juggling utility bills or a small business owner…

How Rent Payments Help Manage Credit Utilization

Credit utilization is a big part of your credit score. It shows how much of your available credit you use. A high ratio hurts your score. A low one helps. But how do rent payments fit in? Rent isn’t credit. But it can be. In 2025, reporting rent to bureaus like Experian can build your…

Financial Tips for Renters in Shared Houses

Living with roommates can be a lifesaver. Rent is crazy high these days—average one-bedroom is $1,730, says Apartment List. Splitting a house makes it affordable. But shared houses come with money headaches. Who pays for what? What if someone skips out? This guide gives financial tips for renters in shared houses. It covers budgeting, bills,…

What are credit Traps and how to avoid them ?

Renting in 2025 feels like a minefield. Prices are up, listings vanish fast, and scammers lurk everywhere. Last year alone, the FTC reported over 70,000 rental scams, costing renters $400 million. That’s cash gone for deposits that never existed. If you’re hunting for an apartment, you can’t afford to fall into these traps. They hit…

How to check and build credit as a renters ?

Renting an apartment in 2025 is no small feat, especially for first-time renters. Your credit score can make or break your chances of landing that perfect place. Landlords are checking credit more than ever, and with inflation pushing up costs, a solid credit score is your ticket to avoiding hefty deposits or outright rejections. If…

Renters Guide to Inflation: Budget Smart in 2025

Renting in 2025 is tougher than ever. With inflation pushing prices up by 3-5%, first-time renters face rising costs for rent, utilities, and groceries. The Renters Guide to Inflation is here to help you navigate these challenges. This comprehensive guide offers practical steps to budget smart, cut costs, and thrive despite economic pressures. Whether you’re…

How to balance Student Loans and Rent?

To balance Student loans and pay rent eat up a big chunk of your budget. If you’re paying $400 a month on loans and $1,200 on rent, it feels like a constant juggle. But you can manage both without drowning. This guide walks you through balancing student loans and rent. It also shares refinancing tips…

Common Rent Reporting Mistakes and How to Fix Late Payment

Rent reporting is a powerful way to build credit by turning your monthly rent payments into a positive mark on your credit report. In 2025, with tools like AxcessRent and Experian Boost gaining popularity, more renters are using this strategy to boost their credit scores. But mistakes in rent reporting can hurt your credit instead…

How to Use Rent History for Job Applications ?

Applying for a job can feel daunting, especially if you’re a recent graduate, career changer, or someone with limited work experience. But your rent history—your record of paying rent on time—can be a powerful tool to showcase your reliability and financial responsibility. In 2025, with more employers using background and credit checks to assess candidates,…

How to use Rent Reporting to Recover from Bad Credit

Bad credit can make life tough. It blocks loans, raises interest rates, and even hurts job or rental chances. But there’s good news. Rent reporting can help you fix it. This method uses your rent payments to build your credit score. No need for new debt. In 2025, with tools like AxcessRent, it’s easier than…

Why Small Landlords Avoid Rent Reporting ?

Rent reporting lets landlords send tenant rent payments to credit bureaus. It helps tenants build credit. But many small landlords skip it. They have reasons. Some are valid. Others are not. This guide explains why small landlords avoid rent reporting. It also shows why they should try it. We’ll cover common issues. And give tips…

5 Ways Rent Reporting Boosts Credit for Low Income Renters and Immigrants

Rent reporting boosts credit for low income renters and immigrants, making it a vital tool for achieving financial stability in the United States. Traditional credit-building options like credit cards or loans often demand an existing credit history, which many low-income individuals and newcomers lack. By transforming monthly rent payments into a credit-building opportunity, rent reporting…

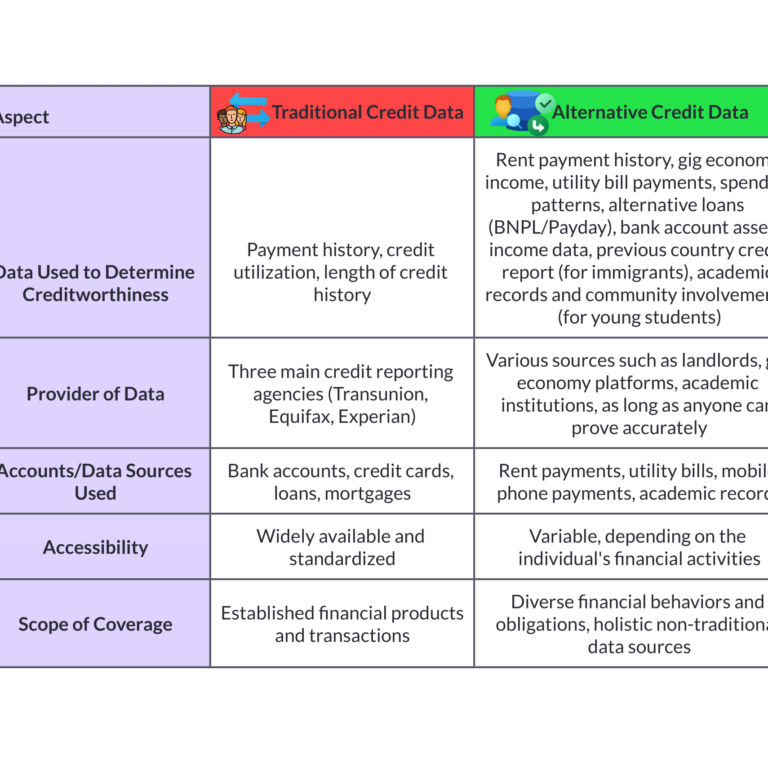

How Alternative Credit Data Helps You Build Credit in 2025

Building a strong credit profile is essential for financial stability, but for millions of Americans especially young adults, immigrants, or those with limited credit history traditional credit data like credit card payments or loans may not tell the full story. Enter alternative credit data, a gamec hanger in 2025 that leverages non-traditional sources like utility…

First Time Renters Guide: How to Rent Your First Apartment

Renting your first apartment is a thrilling milestone, marking a new chapter of independence whether you’re moving out of your parents’ home, leaving a college dorm, or striking out on your own for the first time. But the process can feel overwhelming, especially without prior rental experience. From navigating applications to securing landlord approval, first-time…

What Is a Good Strategy to Improve Your Credit Score?

Improving your credit score is one of the most powerful steps you can take to secure your financial future. A higher credit score opens doors to better loan rates, lower interest on credit cards, and even easier apartment rentals. But it’s not always clear how to raise your credit score effectively, especially with so much…

How to get house ready for rent out in 2025 ?

Renting out your house can be a smart way to earn extra income, build wealth, or cover your mortgage while you’re away. But it’s not as simple as putting up a “For Rent” sign. From legal requirements to finding reliable tenants, there’s a lot to get right to avoid costly mistakes. Whether you’re wondering how…

What Can Void a Three-Day Notice to Pay or Quit? Common Mistakes & Fixes 2026

Dealing with unpaid rent is one of the toughest parts of being a landlord. When a tenant misses a payment, a three-day notice to pay or quit is often the first step to resolve the issue or start the eviction process. But here’s the catch: if this notice isn’t done right, it can be voided,…

Late Rent Notice: Download Free printable PDF Template

Late rent payments are a common challenge for landlords and tenants alike. Whether it’s a simple oversight or a financial hiccup, addressing overdue rent promptly and professionally is crucial to maintaining a healthy landlord-tenant relationship while protecting your legal rights. A late rent notice is your first step in this process, serving as a formal…

How Much is a Security Deposit When Renting in 2026?

Found your dream rental, signed the lease, feeling that new-place glow? Sweet! Until that moment when the landlord casually mentions, “Oh, and the security deposit is…” Suddenly, you’re doing mental gymnastics, trying to figure out where that hefty sum is going to come from. Seriously, it’s often a gut punch, especially if you’re a first-timer…

How to Write a Rent Increase Notice ? (With Free printable Templates)

As a landlord or property manager, drafting a rent increase notice is an essential part of managing rental properties. However, it’s a task that requires careful consideration to maintain positive tenant relationships while ensuring compliance with state and local laws. This SEO-optimized guide provides everything you need to know about creating a professional and legally…

Ohio Squatter Rights: Complete Guide to Laws, Eviction, and Protections in 2025

If you’re a property owner in Ohio dealing with an unexpected occupant, or simply curious about real estate laws, understanding Ohio squatter rights is essential. In 2025, these laws continue to spark debate, balancing property ownership protections with historical concepts like adverse possession. This comprehensive guide dives deep into what squatters are, how Ohio squatter…

Budgeting on a Low Income: Simple & easy Budgeting Hacks

Living on a low income can feel overwhelming. When paychecks barely cover necessities, saving money or planning for the future might seem impossible. But here’s the truth: budgeting is even more important when money is tight. By creating a plan, tracking expenses, and using the right tools, you can stretch your dollars further, reduce stress,…

What is an Emergency Fund? A Complete Guide to Financial Security

Life rarely goes exactly as planned. Cars break down, jobs are lost, medical bills appear out of nowhere, and unexpected expenses can shake your financial stability. Without a safety net, these moments often force people to borrow, swipe credit cards, or drain long-term savings. That’s where an emergency fund comes in. It is your personal…

How to Pay Off Credit Card Debt: Step-by-Step Guide That Actually Works

Credit card debt feels heavy. High interest rates, late fees, and minimum payments trap millions of people in a cycle that looks impossible to escape. If you struggle with multiple balances or feel like your payments never make progress, you are not alone. According to consumer finance reports, credit card debt is one of the…

How Does Medical Collection Debt Affect Your Credit Score?

Medical debt feels different from other types of debt. Nobody plans to get sick or end up in the hospital, yet a single trip to the emergency room can leave you with thousands of dollars in bills. According to the Peterson Center on Healthcare and the Kaiser Family Foundation (KFF), more than 3 million people…

FICO Score Explained: Types, Ranges, and How to Check Yours for Free

Think of your FICO Score as a financial passport—the key that decides which opportunities you can unlock, from renting an apartment to securing a mortgage or even landing the best credit card offers. But here’s the surprising part: there isn’t just one FICO Scores. In fact, there are dozens of versions, each tailored for different…

10 Proven Ways to Turn Money Into More Money (Beginner-Friendly)

Most people dream of making their money work harder. The problem? We’re usually taught how to earn money, not how to turn money into more money. If you’ve ever wondered why some people seem to build wealth while others just get by, the secret often lies in knowing how to make money with money. The…

10 ways to Improve your Credit Score Quickly

Improve your Credit Score feels like a challenge, but it matters more than most people realize. Your credit score works like a grade that follows you everywhere. It decides whether a bank trusts you with a loan, if a landlord approves your apartment application, or if you qualify for a credit card with rewards. A…

Personal Finance Tips for Young Professionals: Building Wealth Early

Introduction: Why Young Professionals Must Master Personal Finance Money is one of the most powerful tools you’ll ever manage—but most of us aren’t taught how to handle it in school. As a young professional, your 20s and early 30s are a critical window to lay the foundation for financial independence. The habits you build now…

How Much Is a Down Payment on a House? Pay Less and Qualify

Introduction You’ve found your dream home, the perfect layout, great neighborhood, maybe even a backyard for your dog.Now comes the big question: How much do you actually need to put down? The answer isn’t one-size-fits-all.While many people assume you need 20% down, the truth is — most buyers don’t pay that much. In fact, the…

How Credit Scores Affect Your Mortgage Rate ? Qualify for the Best Rates in 2025

Introduction Did you know that a 100-point difference in your credit score could save — or cost — you tens of thousands of dollars over the life of a mortgage? Your credit score doesn’t just determine whether you get approved for a home loan; it also heavily influences the interest rate you’ll pay, the loan…

How to Rebuild Credit After Missed Payments: Fix it Now

Introduction: Why Rebuilding Credit Matters More Than Ever If you’ve missed a few payments and your credit score has taken a hit, you’re not alone. Millions of Americans face financial setbacks every year, whether from unexpected medical bills, job loss, overspending, or simple oversight. But here’s the truth: a bad moment in your financial life…

How to Buy Your First Home in 2025: Finally Make Your Dream a Reality

Introduction: Buy your First Home This Year If you’ve ever scrolled through Zillow at 2 a.m., imagined painting the walls of a fixer-upper, or wondered whether you’ll ever be able to afford a down payment — welcome to the club. You’re not alone. In 2025, over 4.3 million Americans are expected to buy their first…

Credit card Utilization in 2025: Expert Tips to Boost Your Credit Score

In 2025, your credit score remains one of the most powerful financial indicators — influencing whether you get approved for a mortgage, how much you pay in interest on auto loans, and even whether a landlord will accept your rental application. Among the many factors that shape your credit score, credit card utilization stands out…

Your Rent Can Finally Work for You: Complete Rent Reporting Guide

Why Every Renter Needs a Rent Reporting Guide For most renters, paying rent feels like money disappearing into a black hole—no equity, no return, just another bill. But what if those same payments could help build your credit score? This rent reporting guide shows you exactly how to make your rent work for you. You’ll…

Why Rent Reporting Is the Credit Hack Every Renter Should Know ? Build Your Credit Score Easily

Why Rent Reporting Is the Credit Hack Most Renters Don’t Know About When people think about improving their credit score, they often imagine paying down credit cards, making extra loan payments, or opening new credit accounts. But there’s a credit hack that can give you results without any extra spending and most renters don’t even…

How Reporting Rent Can Boost Your Credit Score (Proven Way to Start Now )

Your Rent Payment Is Already Building Someone’s Credit—Why Not Yours? Every month, millions of Americans pay their rent on time. They budget carefully, set up auto-pay, and treat it as their top financial priority. Yet, despite this consistent financial responsibility, their credit scores don’t reflect it. Why? Because rent payments are not automatically reported to…

How to Maximize Credit Score Benefits with Rent Reporting: The Effortless way to Building Credit

Your credit score is one of the most powerful financial tools you have—it shapes your ability to qualify for loans, secure credit cards, rent an apartment, and even land certain jobs. But here’s the truth: millions of Americans have lower scores or thin credit files not because they’re financially careless, but because the traditional credit…

How to Choose a Rent Reporting Services in 2025: Easy way to turn Rent Into Credit

For millions of renters across the U.S., rent is the single largest monthly expense. Yet for years, on-time rent payments have gone uncredited—unlike mortgage payments, which directly build credit history. That’s finally changing. Thanks to rent reporting services, tenants can now get recognized for their most consistent financial obligation. By reporting rent payments to major…

Can I Report My Rent Payments to Credit Bureau or Does My Landlord Have To?

Every month, millions of renters across the U.S. make their rent payments on time. No reminders. No stress. Just another responsible financial decision done quietly in the background. But here’s the hard truth: unless that payment is reported to a credit bureau, it doesn’t help your credit score one bit. For decades, this was the…

Best Rent Reporting Services in 2026: Compare Top Options to Build Credit

How to Turn Your Rent into Credit-Building Power in 2026 If you’re like millions of Americans, your rent is your largest monthly financial obligation. Yet for years, on-time rent payments were invisible to credit bureaus—meaning all that financial responsibility went unnoticed when you applied for a loan, credit card, or even an apartment. That’s changing….

Credit Bureaus and Rental Reporting: What You Need to Know

For decades, your creditworthiness was determined by a narrow set of financial behaviors: Do you pay your credit cards on time? Are your loan payments up to date? What’s your debt-to-income ratio? But what about your rent? Millions of Americans make on-time rent payments every month—often their largest and most consistent financial obligation—yet this responsible…

Reported vs Verified rent Explained: Why Rent Reporting Is as Powerful as Loan Payments

When it comes to building credit, most people think of loans and credit cards. But what if your monthly rent payments could count just as much? Increasingly, rent payments are treated similarly to loan payments when reported to credit bureaus—offering a powerful tool for financial inclusion. Yet, there’s a crucial distinction: reported doesn’t always mean…

How Rent Payments Affect Your Credit Score: Supercharge Your Credit Without Debt

Introduction For millions of renters across the U.S. and beyond, rent is the single largest monthly expense — often even higher than a mortgage payment. Despite the financial responsibility this represents, traditional credit reporting systems long ignored rent payments when calculating credit scores. That meant on-time rent payments, made consistently month after month, did little…

The Hidden Truth: Why Traditional Credit Building Fails Millions in 2025

When we talk about building credit, most advice boils down to one familiar phrase: “Get a credit card.” While this approach has worked for millions, it’s far from one-size-fits-all. In fact, relying solely on traditional credit building methods can leave many people behind, especially those with low income, limited credit history, or unique financial situations….

Why Credit Matters More Than Ever in 2025: A Deep Dive Into Financial Freedom

Introduction: Why Credit Matters More Than Ever in 2025 In today’s fast-moving digital economy, your credit score is more than just a number — it’s your financial fingerprint. It affects your ability to rent an apartment, get a car loan, qualify for a mortgage, or even land a job. And in 2025, with inflation, rising…

What Is Rent Seeking? Shocking Examples and Its Hidden Economic Costs

Rent seeking is a foundational yet often misunderstood concept in economics and political science. At its core, it refers to efforts by individuals, corporations, or interest groups to increase their wealth without producing new value or contributing to the economy’s growth. Rather than earning profits through innovation, entrepreneurship, or improved services, rent seekers exploit existing…

From Renting to Owning: 10 Secrets steps to Knowing You’re Ready

For many people, renting is the default starting point when it comes to finding a place to live — and for good reason. It offers flexibility, fewer long-term obligations, and allows you to sidestep many of the ongoing responsibilities that come with owning a home, like maintenance, property taxes, and homeowner’s insurance. Renting can be…

How to Be a Successful Long Distance Landlord: 15 Expert Tips

Managing rental properties is no walk in the park, and doing it from hundreds—or even thousands—of miles away? That can feel overwhelming. Whether you’re moving for work, investing in out-of-state properties, or managing a home you inherited, becoming a long distance landlord is entirely doable—if you have the right strategies in place. This comprehensive guide…

What Is a Triple Net Lease (NNN) ? Benefits, Risks, and FAQs

If you’re diving into the world of commercial real estate investing or leasing for the first time, you may come across a term that pops up frequently: Triple Net Lease (NNN). It’s one of the most common lease structures out there, and for good reason. But what is a triple net lease, really? How does…

What is Effective Rent? Essential Insights and Calculation Tips

When evaluating commercial real estate leases—especially in office, retail, or industrial properties—landlords and tenants often come across the term effective rent . But what exactly is effective rent, and why is it so important in lease negotiations and property valuation? In this comprehensive guide, we’ll explore: Whether you’re a landlord setting lease rates, a tenant…

10 Things to Consider When Renting a House: A Comprehensive Guide for Renters

Deciding whether to rent or buy a house is one of the most important financial and lifestyle choices you’ll face. Renting offers benefits like flexibility, lower upfront costs, and fewer maintenance responsibilities, making it an attractive option for many. However, it’s not without its downsides—especially when it comes to long-term financial growth and stability. Understanding…

Tenants Stay After Their Lease Expires – Protect Your Property Fast

As a landlord, one of the most important aspects of property management is understanding the legal and practical implications of tenant behavior—especially when it comes to lease agreements. While many landlords worry about tenants leaving early or breaking their lease, another common issue is just as problematic: tenants stay after their lease expires. This situation…

How Much Can a Landlord Charge for Damages? Avoid Costly Mistakes

Being a landlord comes with many responsibilities, and one of the most frustrating parts is dealing with property damage after a tenant moves out. While some wear and tear is expected, excessive damage can result in costly repairs and extended vacancy time. This is where understanding how a landlord charge for damages becomes crucial. Most…

How Lease Extensions and Renewals Work (And Which One Saves You Money)

Whether you’re a landlord managing multiple properties or a tenant who loves your current rental, understanding the difference between lease extension and lease renewal is critical. While both aim to continue a rental arrangement beyond its original end date, they come with different legal implications, contractual terms, and practical outcomes. In this guide, we’ll explore…

Non-Renewal Lease Letter Templates That Protect Your Rights in 2025

When a lease is coming to an end, both landlords and tenants face a critical decision—should the lease be renewed or terminated? If either party decides not to renew, delivering a non-renewal lease letter is not just a courtesy—it’s often a legal necessity. In this guide, we’ll walk you through everything you need to know…

What are squatters rights? Many Landlord don’t know it

As a landlord or property owner, discovering that someone has moved into your property without permission can be both shocking and stressful. When dealing with squatters rights, it’s important to understand that the legal landscape surrounding unauthorized occupants is complex and varies significantly by jurisdiction. Whether the individual is a short-term trespasser or a long-term…

Can You Pay Rent With a Credit Card? The Ultimate Guide to Pros, Cons, and Smart Strategies

Paying rent is one of the largest monthly expenses for most people, often consuming 30–50% of their income. With such a significant outlay, it’s natural to wonder: Can I pay rent with a credit card to earn rewards, improve cash flow, or build credit? The short answer is yes, but the real question is whether it’s financially wise….

What Is a Bad Tenants List or Do Not Rent List?

As a landlord, avoiding problem tenants is crucial, but relying on unregulated “Bad Tenants Lists” or “Do Not Rent Lists” can backfire. These informal blacklists, which compile names of tenants with past issues (late rent, property damage, etc.), often lack verification, violate privacy laws, and risk unfair discrimination. Instead, a legal, transparent tenant reporting system (like Landlord Credit Bureau)…

How to Build Credit as a Student: The Ultimate Guide to Financial Success

College is a time for growth, discovery, and your first real taste of financial independence. But amid classes, part-time jobs, and campus life, one crucial skill often gets overlooked—how to build credit as a student. Establishing credit early can give you a powerful head start toward long-term financial success. You might be thinking, “Why worry…

How much can your landlord raise your rent ?

Landlord Raise Rent policies are a hot topic across the U.S., especially as housing markets fluctuate and inflation impacts the cost of living. Whether you’re a landlord aiming to adjust rent according to market value or a tenant concerned about sudden increases, understanding how often a landlord can raise rent is crucial for staying informed,…

What Is a Rent Concession? A Strategic Move That Builds Rental Success

In today’s competitive rental market, landlords are going beyond traditional offers to attract quality tenants—and one of the most effective tools in their arsenal is the rent concession. But what exactly is a rent concession, and why does it matter for both landlords and tenants? Whether you’re a property owner looking to fill vacancies or…

How to Do a Background Check on a Tenant ? Proven Steps for Landlord Success

Renting out a property can be both rewarding and risky. As a landlord, you’re handing over access to one of your most valuable assets—your property—and placing your trust in a tenant to not only live there responsibly but also pay rent on time, take care of the space, and follow the lease terms. That’s why…

10 Common Mistakes Landlords Can Make (And How to Avoid Them)

Being a landlord can be a rewarding experience—but it also comes with a steep learning curve. Among the most important lessons to learn early are the common mistakes landlords can make. Whether you’re renting out a single property or managing a growing portfolio, success in real estate isn’t just about buying a property and collecting…

Your Credit in Retirement: Why It Still Matters and How to Protect It

Retirement is often thought of as a time to relax, slow down, and enjoy the fruits of decades of hard work. You’ve spent your working years building a nest egg, planning for the future, and managing your money wisely. But even in this new chapter of life, credit in retirement remains surprisingly important. Now that…

What to Do if Your Identity Is Stolen: A Step-by-Step Recovery Guide

Discovering that someone has stolen your identity can feel like your entire life has been flipped upside down. Fraudsters may use your personal information to open credit cards, take out loans, file fake tax returns, or even access your bank accounts. What’s worse—this damage can happen silently for weeks or months before you even realize…

What Is a Credit Builder Loan? A Complete Guide to Building Credit from Scratch

When it comes to building credit, starting from scratch or recovering from past mistakes can feel overwhelming. Traditional credit cards and loans often require a strong credit history—but how do you build credit when you don’t have any? That’s where a Credit Builder Loan comes in. Unlike typical loans, a credit builder loan is designed…

What Credit Score Is Needed to Buy House?

Buying a home is one of life’s biggest milestones—but also one of its most complex. From picking the right neighborhood to navigating closing costs and interest rates, there’s a lot to consider. However, one thing impacts nearly every step of the mortgage process: your credit score. Whether you’re a first-time homebuyer or upgrading to a…

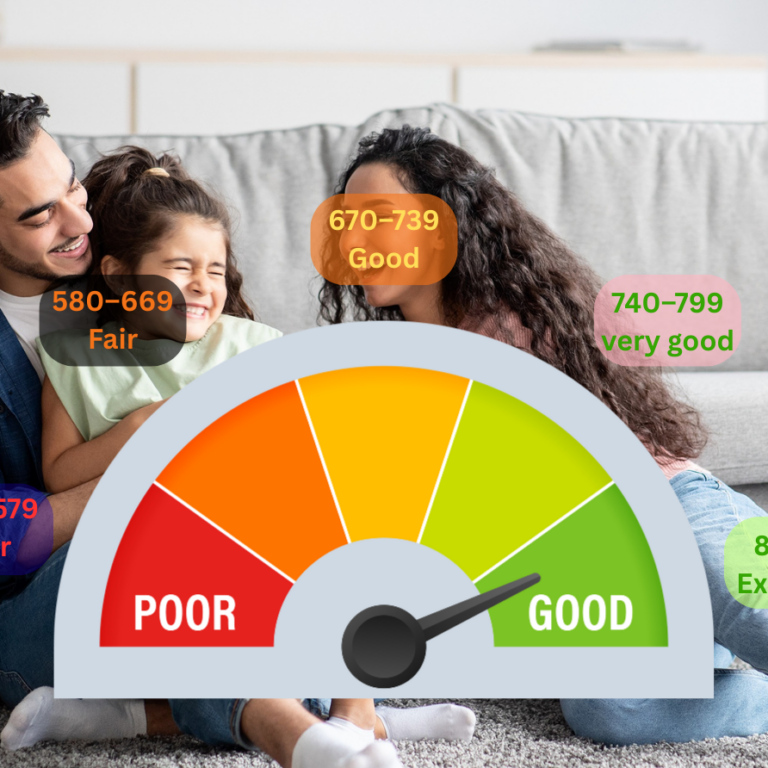

What Is a Good Credit Score? A Complete Guide to Understanding and Improving Your Credit

When it comes to your financial well-being, few numbers carry as much weight as your credit score. Whether you’re applying for a mortgage, financing a car, or just trying to get approved for a credit card, lenders use this number to decide how trustworthy you are as a borrower. But what exactly counts as a…

How to Use Rent Reporting to Absolutely Attract Long-Term Tenants: The #1 Hook for Landlords

As a landlord or property manager, one of your biggest challenges is figuring out how to attract long-term tenants who pay rent on time, respect your property, and reduce costly turnover. While screening tools and lease terms help, there’s one underrated strategy that directly appeals to stable, financially-minded renters: rent reporting. When tenants know that…

Placing or Lifting a Credit Freeze: What You Should Know

When it comes to protecting your financial identity, few tools are as powerful and effective as a credit freeze. Whether you’re concerned about identity theft, have been a victim of a data breach, or simply want to prevent unauthorized access to your credit, freezing your credit report is a smart and proactive step. This comprehensive…

Protect What Matters: How Smart Landlords Prevent Fraud and Identity Theft

Rental properties are valuable investments—but they also attract fraudsters, identity thieves, and unqualified renters who can put your business at serious risk. With the increase in online listings and remote rental applications, the landscape has become even more vulnerable. According to recent data, rental application fraud has increased by over 30% in recent years—putting both…

Stop Credit Damage: How to Contact the Company That Made a Hard Inquiry

Spotting a suspicious hard inquiry on your credit report can feel like a red flag — and for good reason. Hard inquiries, especially those you didn’t authorize, can affect your credit score and hint at potential fraud. While filing a dispute with the credit bureaus is one route, contacting the company that made a hard…

What Is Rent Reporting? How It Builds Credit & Boosts Your Financial Future

You Pay Rent Every Month—So Why Isn’t It Helping Your Credit? Let’s be honest: rent is probably your biggest monthly expense. You budget for it, set up reminders, and make sure it’s paid on time, every single month. You treat it like any other serious financial obligation. But here’s the frustrating truth: none of that…

How to Dispute Hard Inquiry on Your Credit Report and Win

Dispute hard inquiry entries on your credit report as soon as you spot them — especially if you didn’t authorize them. Your credit report is a key factor in determining your financial opportunities, whether it’s qualifying for a mortgage, getting a credit card, or even applying for a job. That’s why it can be so…

How to Spot Unauthorized Hard Inquiries on Your Credit Report — Before They Hurt Your Score

When it comes to your financial well-being, your credit report is more than just a number—it’s your financial reputation. But what if something appears on your report that you didn’t authorize? That’s where unauthorized hard inquiries become a serious concern. These can quietly drag down your credit score, raise red flags to lenders, and even…

How to Get Your Free Credit Report from All 3 Bureaus: Fast and Secure

Why You Need Your Credit Report First Before applying for any financial product whether it’s a credit card, loan, mortgage, or even renting an apartment your credit report plays a critical role in the decision-making process. It acts as your financial résumé, showing lenders how responsibly you’ve managed credit in the past. That’s why checking…

What is Soft Credit Check? Working and impact on credit score

When managing your personal finances, especially credit, understanding the different types of credit checks is essential. Whether you’re applying for a loan, checking your own credit score, or receiving pre-approved offers in the mail, chances are your credit is being checked either through a soft inquiry or a hard inquiry. While most people focus on…

How long do hard enquiries stay on credit report ?

If you’ve ever applied for a loan, credit card, or even a phone contract, chances are you’ve come across the term “hard enquiry.” These enquiries are part of your credit profile and can influence how lenders view your financial responsibility. But many people are confused about what exactly a hard enquiry is, how it affects…

Credit Inquiries Explained: Smart Ways to Protect & Grow Your Credit

Whether you’re applying for a credit card, mortgage, car loan, or even renting an apartment, your credit report will likely be reviewed by a lender or landlord. One crucial component of that credit report is credit inquiries. While they may seem minor, understanding how inquiries work can help you better manage your credit profile, avoid…

The Ultimate Guide to Creditworthiness: Boost Your Credit Fast

Introduction In a world where financial decisions often speak louder than words, your creditworthiness tells a story one that lenders, landlords, and even employers are reading. Whether you’re applying for a credit card, seeking a home loan, or simply trying to rent an apartment, your credit profile acts like your financial résumé. But what exactly…

How to write Past Due Rent Notice: Free PDF Template Download

Rent collection is one of the most essential and often most sensitive parts of being a landlord. While many tenants pay on time, others may fall behind due to financial difficulties, miscommunication, or negligence. When this happens, the proper way to handle the situation is with a Past Due Rent Notice. This guide explains what…

How to Calculate Risk Premium: Step-by-Step Guide with Examples

In the world of investing and finance, risk is an unavoidable companion. Whether you’re buying stocks, bonds, or starting a business, there’s always a chance things won’t go as planned. That’s where the risk premium comes in. The risk premium is a crucial concept that explains why investors demand higher returns when they take on…

Mastering Loan Repayment: A Stress-Free Guide to Your Financial Freedom

Let’s face it loans are part of adulting. Whether you’re financing your education, buying wheels, or stepping into your first home, borrowing money is often necessary. That initial excitement of getting approved? It fades fast when the first payment reminder hits your inbox. Suddenly, that helpful loan becomes very real debt you need to manage. The…

How do landlords track missed or late payments?

Keep track of rental payments with a system that makes rent collection simple and stress-free. Whether you manage one unit or fifty, accurate records help prevent missed income, late fees, and legal issues. With the right tools, you can stay organized, reduce disputes, and make smarter financial decisions. This guide explains why rent tracking matters,…

How Much Rent Can I Afford in 2026? Free Calculator & Tips

Before diving into apartment listings or rental websites, it’s important to ask yourself one key question: how much rent can I afford? A common starting point is the 30% rule, which recommends spending no more than 30% of your gross monthly income on rent. While this is a helpful guideline, it doesn’t fit everyone’s situation….

How Do Landlords Check for Evictions? Best practices for property managers

When applying for a rental property, your past rental history is one of the most critical factors landlords consider. Among the biggest red flags? A previous eviction. But how do landlords check for evictions records? Do they rely on public databases, tenant screening reports, or references from past landlords? In this comprehensive guide, we’ll break…

Tenants’ Rights When a Landlord Sells the Property: A Complete Guide

Finding out your landlord is selling the rental property you live in can be stressful and unsettling. Concerns about eviction, sudden rent increases, or losing your home unexpectedly are common but the good news is, tenants rights. Even when ownership changes, the law provides important protections to ensure renters are treated fairly. In this in…

How to Calculate the Optimal Rental Rate to Maximize Profit and Attract Quality Tenants

Determining the optimal rental rate for your property is arguably the single most impactful decision you’ll make as a landlord. This isn’t just about filling a vacancy it’s about strategically positioning your investment for long-term success. Price your property too aggressively, and you may face months of frustrating vacancy as prospective tenants scroll past your…

Good Credit Score= Great Loans: DISCOVER Your Best Options

Having a good credit score opens doors to better financial opportunities, including favorable loan terms, lower interest rates, and higher approval chances. If you’ve worked hard to maintain a strong credit history, you’re in a great position to secure loans that meet your needs. In this guide, we’ll explore the types of loans you can qualify for…

How to Understand and Write a Rental Agreement: A Step-by-Step Guide

Introduction Signing a rental agreement is a significant commitment, whether you’re a tenant looking for a new home or a landlord renting out a property. This legally binding document outlines the rights and responsibilities of both parties, so understanding every clause is crucial to avoid disputes later. Many renters and even some landlords skim through…

What are benefits of Rent Reporting for Landlords?

Rent Reporting for Landlords As a landlord, ensuring consistent and on-time rent payments is critical for maintaining steady cash flow and long-term profitability. Yet, many tenants are unaware that their monthly rent payments could help them build or improve their credit score. This is where Rent Reporting for Landlords comes in—by reporting rent payments to…

Tenant Screening Guide: How to Screen Tenants Like a Pro in 2025